Welcome back to the Wolf’s Den,

This market is absolutely insane.

I have never seen a stock run like AMTD Digital Inc. (NYSE: HKD)…

On July 15, 2022, it was trading just above $10. Just for fun, how many shares could you buy?

Now multiply that number by $2,400 … that’s how much your stock would be worth as of yesterday.

And that’s not the only spiker right now…

I’m mainly watching three hot stocks on a run.

There are more spikers out there, but my plan is to focus on ones with a low float. They have a higher probability of continued upward momentum.

Lower floats mean fewer shares supplied. And a constrained supply means the price can spike higher.

Best of all, there’s only one pattern you need to watch for … it’s the same pattern HKD followed!

Stop waiting around, the opportunities right now are crazy!

The Mother of All Patterns

Here’s the craziest part about all of this…

Millionaire trader and mentor, Tim Sykes, went live last week and showed traders this pattern firsthand.

That was on Thursday, July 28. When HKD was still trading below $200. Yesterday it spiked up to $2,600.

If you watched the livestream, you still had a 1,200% upside potential. That’s completely ridiculous.

Now, HKD is pretty over-extended. It’s very possible it keeps running. But you’d be taking a big risk buying this high. Also, who’s got $2,000 lying around to buy one share? That’s not how I want to trade.

Instead, I’m looking for the next low-priced stock ready to shoot for the moon. A big spiker like HKD will send shockwaves throughout the industry. And we’re already seeing more tickers follow…

You missed last week’s live stream, but there’s no point crying over spilled milk. Luckily, Sykes recorded it and there’s still a chance to discover the market’s #1 pattern.

This time next week, are you gonna be up a couple thousand? Or are you gonna miss this opportunity again?

It’s your decision…

3 Stocks

I’m watching each of these tickers for a move like HKD’s…

If a big runner shows up on your scan with a low float (less than 10 million shares), add it to the list.

The only way to profit in this niche is to keep tabs on the hottest stocks.

Here you go…

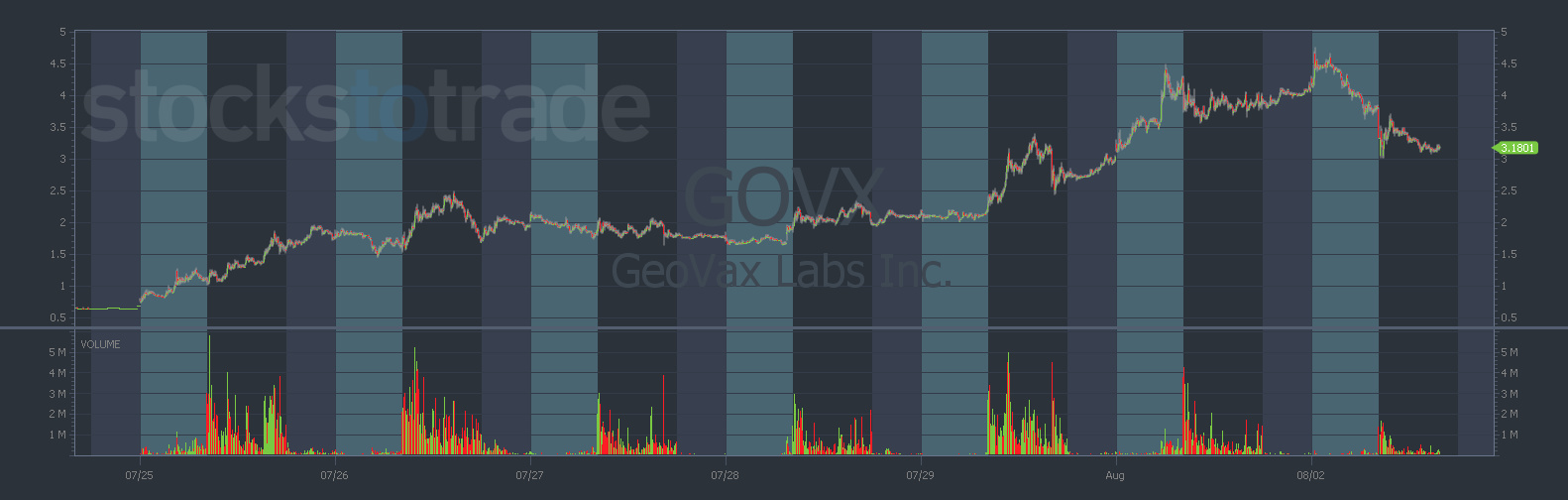

#1 GeoVax Labs Inc. (NASDAQ: GOVX)

This thing continues to spike higher. It’s been on my watchlist for weeks now, and there’s no end in sight…

GOVX chart Source: StocksToTrade

Biotech stocks are having a field day right now. And this is a good example…

The sector falls in and out of popularity. Right now there’s a lot of hype because of monkeypox.

The chart shows a clear top at $4.50, that’s the resistance I want it to break through. But first it’s gotta hold the $3 support level…

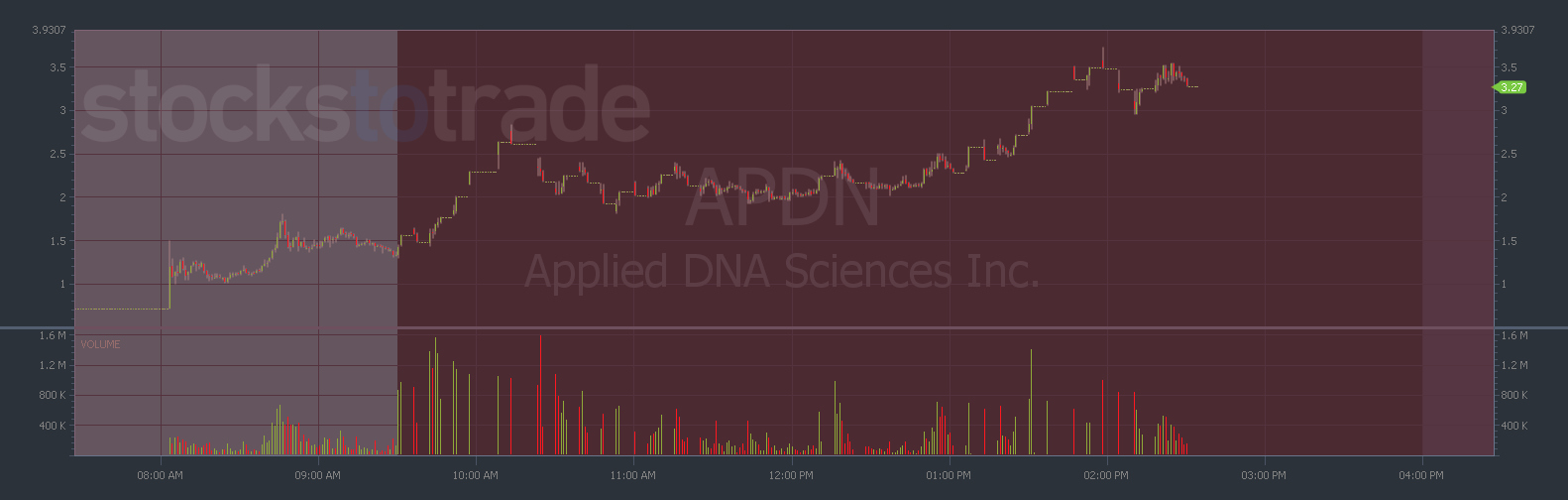

#2 Applied DNA Sciences Inc. (NASDAQ: APDN)

Here’s another monkeypox play. It looks suspiciously similar to HKD…

The chart right now shows that it’s halted. Sometimes trading halts happen when listed stocks are too volatile.

It can be sketchy to play stocks that halt but go take a look at the HKD chart. It halted all over the place on its way to highs.

Aside from that, the chart is actually really clean. We can see defined levels of support and resistance. I’m excited to see where this thing goes next…

APDN chart Source: StocksToTrade

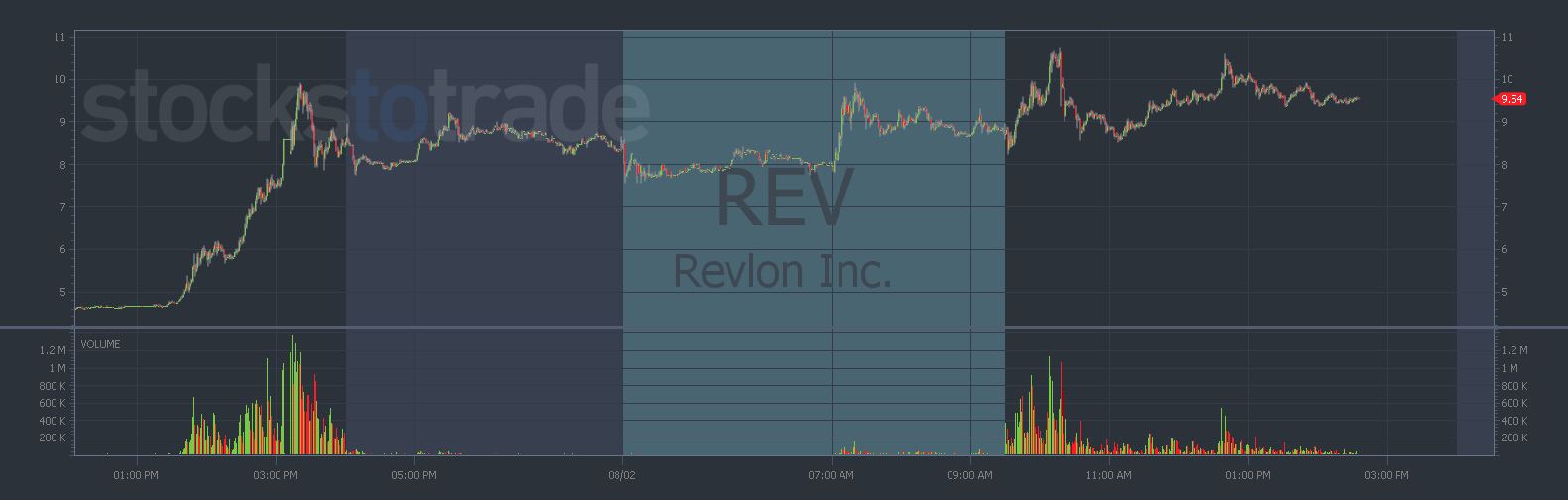

#3 Revlon Inc. (NYSE: REV)

This is a massive short squeeze.

Not as big as HKD, but we’re in the beginning stages.

Before you get in, notice the failed breakout over $10.

This stock could come tumbling down, it could shoot higher. In the near term, a breakout isn’t likely considering resistance at $10.

But we’ve seen stocks like this run for days.

Now is the perfect time to watch this stock, let it pull back and bottom out. Then, if it starts rebounding, I’ll size in accordingly with set risk.

REV chart Source: StocksToTrade

This Is Not a Drill

Time to get off your butt and make some cash.

Screw the larger market. Don’t waste your time selling for a couple of percentage points here and there.

We’ve got bigger fish to fry…

Penny stock trading offers the most opportunities to profit during a slow market.

Every minute you ignore this niche is a minute wasted …

This is gonna change your trading forever.

Don’t miss the next move,

Roland Wolf

Editor, The Wolf’s Den

P.S. Want to trade the next HKD? This is the pattern you need …

All content in this newsletter is intended for educational and informational purposes only.

The material in this newsletter is not to be construed as (i) a recommendation to buy or sell stocks, (ii) investment advice, or (iii) a representation that the investments being discussed are suitable or appropriate for any person. No representation is being made that following The Wolf’s Den’s strategies will guarantee a particular outcome or result in profits. The price and value of stocks may fluctuate depending upon various market factors, and, as such, the strategies used by The Wolf’s Den to adjust for those fluctuations may change without notice.

There are significant risks associated with trading stocks and you must be aware of those risks, and willing to accept them, in order to invest in these markets. Past performance of any trading system or methodology is not indicative of future results. You should always conduct your own analysis before making investments.

You should not trade with money you cannot afford to lose and there is a risk that trading stocks will result in a complete loss of your investment. Trading stocks, particularly penny stocks, is not suitable for everyone and requires hard work, due diligence, capital, and substantial time to monitor the market and timely execute trades.