Welcome back to the Wolf’s Den,

If you’re not making money in this market, you’re not alone.

Despite the massive rally we’ve seen in stocks, the broader market is still deep in the red.

But that isn’t the case for everyone.

In fact, a few traders I know, like Jack Kellogg and Tim Lento, are up a cool 7-figures this year, with five months still to go.

And while they’re excellent traders, it’s not so much the strategies they trade that have helped them crush the market.

It’s been their stock selection.

If you find yourself, constantly on the wrong side of the trade … then it probably has to do with you picking the wrong stocks to play.

Lucky for you, we can fix that…

By ‘we’, I mean Sykes and his team of millionaire students. And the team continues to grow…

I am killing $APDN again to day bought $3.70, just killed it $6.60, same as $GOVX what a beautiful week OMG , THANK YOU LORD THANK YOU TIM pic.twitter.com/dZkIbt0Qjn

— Kalu Perera (@PereraKalu) August 4, 2022

The beauty behind Sykes’ process is its simplicity.

He’s been using the same framework for over 2 decades in a niche tucked away from big Wall Street sharks.

It’s the perfect way for traders with small accounts to start out.

Because in the grand scheme of things, Wall Street doesn’t care about Jack or Tim making a few million. They play with billions.

That’s what keeps our club safe. Wanna join?

It starts with these 3 stocks…

The Secret to Profits

Without a doubt, these are the hottest and most volatile stocks in our niche right now.

But it doesn’t mean I can just buy them at random and wait to sell at a higher price.

This volatility works both ways. Stocks can spike thousands of percentage points (go look at AMTD Digital Inc. (NYSE: HKD)) but there’s chop in between. And if I buy at the wrong point, I could see huge losses before any gains.

Growing A Small Trading Account? Check this Out

When multi-millionaire trader Mark Croock first started trading, he was an overworked and underpaid accountant…

So he knows what it’s like to start small while wanting to massively grow your wealth as quickly as possible.

That’s why he just recorded a step-by-step training that reveals what he believes is the best options trading method for someone trading with a small account.

Once I found the right stocks, the biggest issue I had starting out was … I kept buying and selling at the wrong points.

It happens to a lot of traders in the beginning. But there’s a simple fix.

You’ve gotta watch one of us trade in real-time.

We hold live webinars every so often. But if you want to speed up the process, go through the live trade webinars.

History doesn’t repeat, but it does rhyme. A few live trades under your belt and things will start to click. Trust me.

3 Stocks

Like I said before, we won’t see 100% identical moves on these stocks, but they’re already following basic patterns.

Pattern recognition is huge when it comes to trading. If the chart doesn’t make sense, I can’t profit.

Make sure you’re watching stocks with charts like these…

#1 Society Pass Incorporated (NASDAQ: SOPA)

This popped up yesterday after promising Q2 financial results.

It’s got a low float, only 16 million shares. And the volume rotated the float several times.

I’m waiting for a breakout over $3.

SOPA chart Source: StocksToTrade

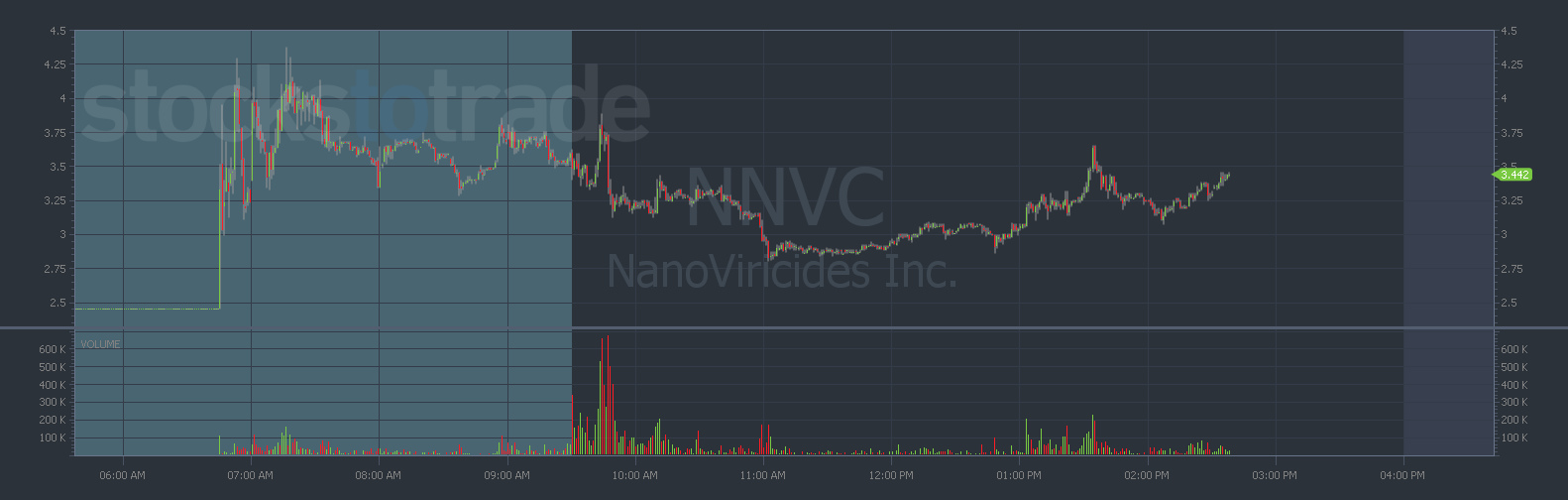

#2 NanoViricides Inc. (AMEX: NNVC)

This is a low-float monkeypox play that gapped up 46% yesterday. There are only 10 million shares outstanding.

As I’m writing this it has yet to break out. But it dipped nicely at $2.75. That could be the level it bounces from.

NNVC chart Source: StocksToTrade

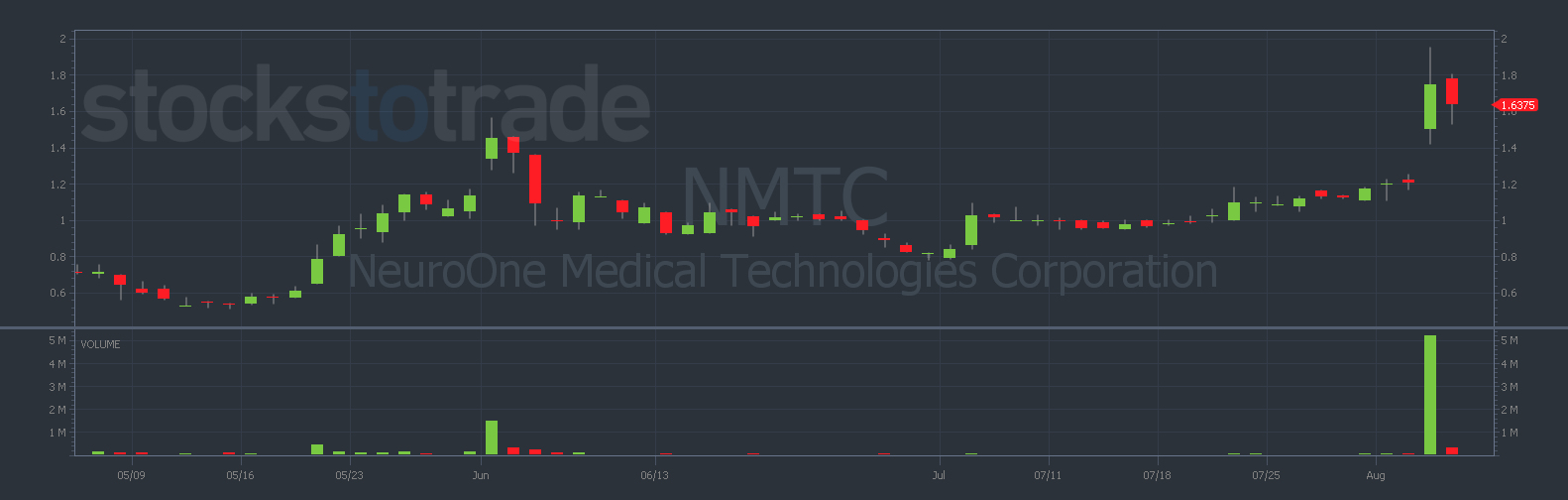

#3 NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)

Last but not least, this is a low-float multi-day breakout that might bounce off support in the $1.50 area. There are 15 million shares outstanding.

If you’re wondering why I focus on low-float stocks, a lower supply of shares will cause the price to spike higher. And those are the stocks I want to trade.

I’m gonna let it put in a solid bottom and then watch for the move higher.

It’s also got recent news to push it higher.

NMTC chart Source: StocksToTrade

How I Made $1 Million in Profits

I used to be where you are.

I worked a 9 – 5 job and wanted to make a few extra bucks from day trading.

But when I was introduced to Sykes and his process, I knew I’d stumbled upon something much bigger than extra pocket cash.

Maybe this is the right process for you too. Come check it out…

Welcome to the club,

Roland Wolf

Editor, The Wolf’s Den