In this market, there’s one thing you gotta know…

Fear creates volatility. And volatility creates profit opportunities.

And right now, there’s nothing hotter than small-cap momentum stocks.

Professional traders like Tim Sykes have been trading them successfully for decades…

And his students are thriving as well.

I LOVE MY STUDENTS, EVERYONE GP CONGRATULATE @yamsayingg ON SURPASSING $300,000+ TODAY!!! https://t.co/cWA9rJnqXl

— Timothy Sykes (@timothysykes) July 25, 2022

If you really want to make money in this market then you have to follow the money. I’ve uncovered five stocks that I think are ready to take off.

Here are the 5 stocks every trader should be watching…

More Profit Opportunities

Stock patterns are an essential tool for all traders.

Without a map to guide us, the volatility would be too dangerous.

The more patterns a trader knows, the more opportunities to profit they have. Make sense?

The tough part is choosing which patterns to learn. There are a lot out there.

Check out this post to see what I mean…

If you want to start with the hottest pattern right now, you’re in luck!

There’s going to be a live webinar tomorrow, July 28 at 8 p.m. Eastern. My mentor, Tim Sykes is going to share one of his most profitable patterns.

I’m a millionaire trader, but I still learn every day. That’s how I stay profitable.

5 Stocks for This Week

Put these tickers on your watchlist. And keep checking on them day after day.

Past runners can run again. That’s why watchlists are so important.

You can access my daily watchlists right here.

But if you want to become self-sufficient, here’s what I look for every morning…

- Listed stocks below $5

- Spiking at least 20%

- Low volume (below 10 million shares)

- High trading volume (at least 1 million shares)

- Credible news

If a stock pops up with these criteria, add it to the list and wait for a perfect setup.

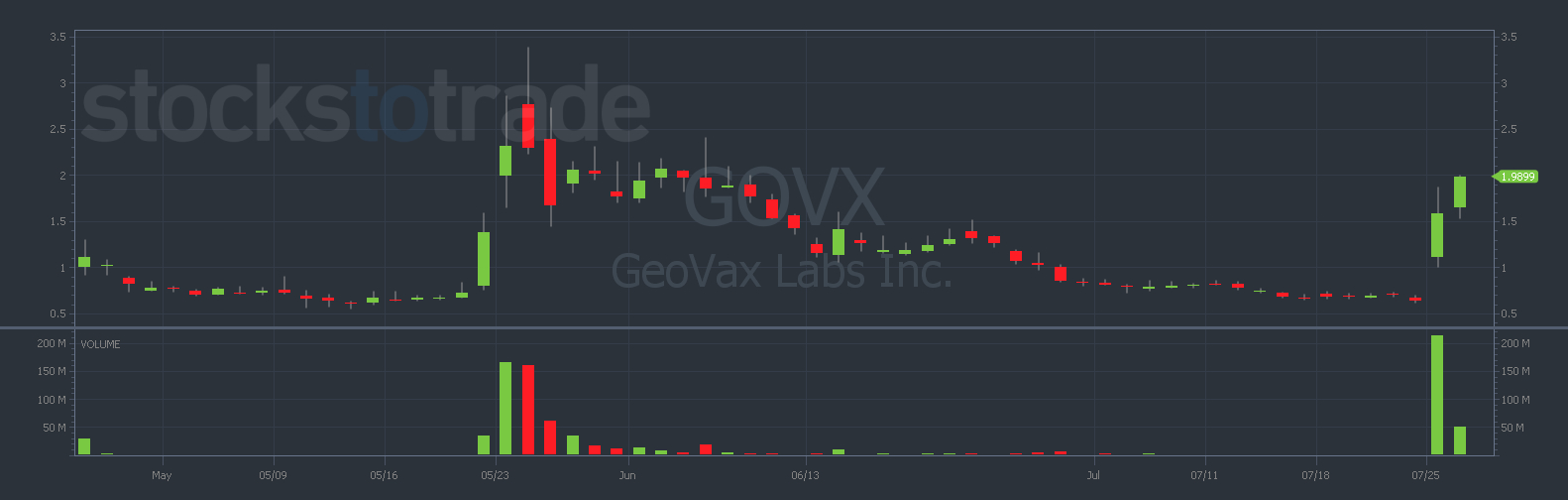

#1 GeoVax Labs Inc. (NASDAQ: GOVX)

This biotech ran last May, and now it’s back for round two.

It’s got earnings coming up and the biotech sector is kind of hot right now.

There’s some monkeypox fear going around, it’s a good catalyst to keep an eye on.

Not to mention the float is only 12 million shares and the volume shows 180 million shares traded. That’s a huge float rotation.

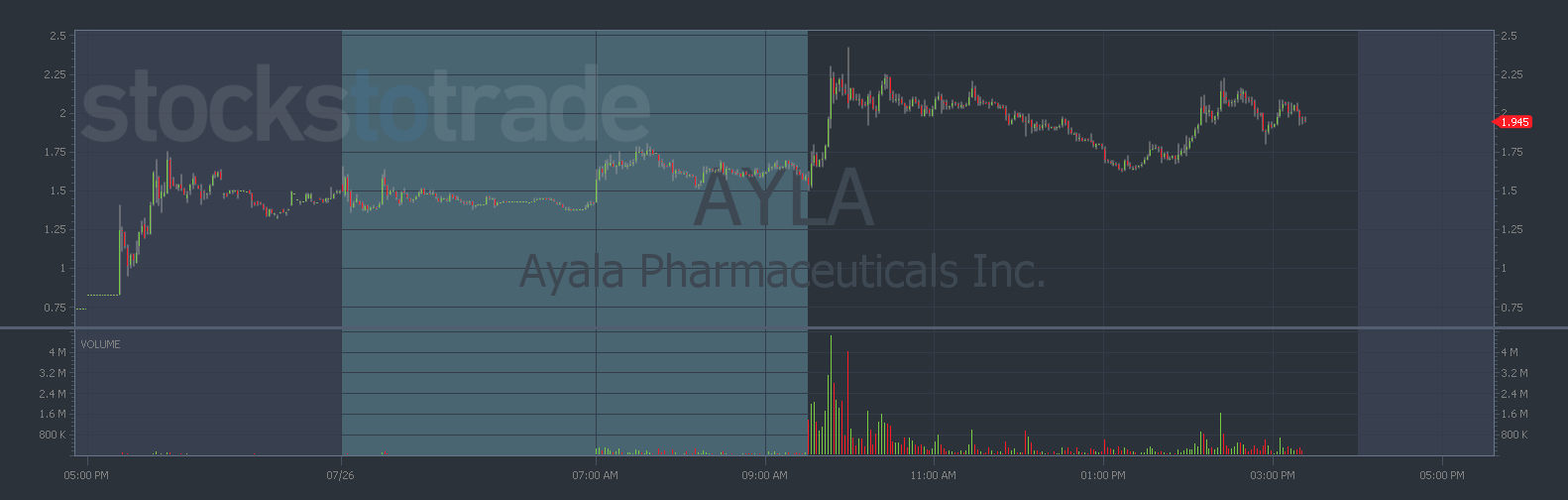

#2 Ayala Pharmaceuticals Inc. (NASDAQ: AYLA)

There are a few biotechs running right now. This is another one.

It’s got a 5 million share float. Try StocksToTrade for up-to-date market data.

There’s also a recent request to cancel a dilution.

A stock dilution is when more shares are added to the market. This makes the price per share cheaper. Therefore, canceling the dilution is a bullish catalyst.

#3 Freight Technologies Inc. (NASDAQ: FRGT)

Supply chain issues have run rampant ever since COVID started.

This means that any company able to fill shipping demand is in a great spot to profit.

And this firm was just awarded a contract with Samsung.

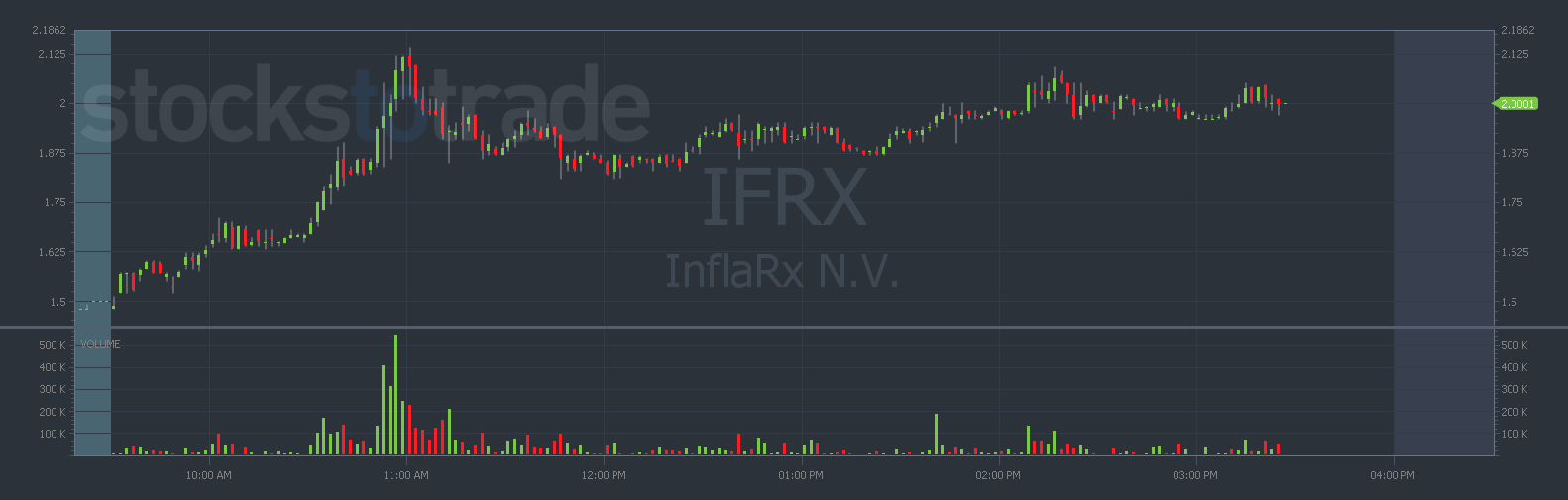

#4 InflaRx N.V. (NASDAQ: IFRX)

Here’s another biotech running on COVID news.

It’s not as hot of a catalyst as it was during 2020. But there are still people around the world suffering from sickness. So I wouldn’t be surprised to see this thing break out.

It’s got a little bit of a bigger float but still under 100 million shares.

#5 Sunshine Biopharma Inc. (NASDAQ: SBFM)

This biotech/drug manufacturer has a huge history of running.

I’m talking a gap up from below $1 all the way to $10 … and it’s on the move again.

There isn’t any recent news. But it’s in a hot sector. If they decide to drop a press release I’ll be ready.

Don’t Miss This Event

This is quite literally the best trading opportunity of the summer.

If it’s the only thing you do Tomorrow, make sure to take notes on Sykes’ webinar.

Everyone starts trading to make money … but very few people actually achieve their goals.

Usually, because they don’t know what to look for…

Reserve your spot to discover this summer’s biggest profit opportunity.

Capitalize on this volatility,

Roland Wolf

Editor, The Wolf’s Den

P.S. Tim Sykes believes the next 46 days can lead to 10x gains. There’s a rare opportunity setting up … Want to get involved? Register today for this exclusive event to get all the details.

All content in this newsletter is intended for educational and informational purposes only.

The material in this newsletter is not to be construed as (i) a recommendation to buy or sell stocks, (ii) investment advice, or (iii) a representation that the investments being discussed are suitable or appropriate for any person. No representation is being made that following The Wolf’s Den’s strategies will guarantee a particular outcome or result in profits. The price and value of stocks may fluctuate depending upon various market factors, and, as such, the strategies used by The Wolf’s Den to adjust for those fluctuations may change without notice.

There are significant risks associated with trading stocks and you must be aware of those risks, and willing to accept them, in order to invest in these markets. Past performance of any trading system or methodology is not indicative of future results. You should always conduct your own analysis before making investments.

You should not trade with money you cannot afford to lose and there is a risk that trading stocks will result in a complete loss of your investment. Trading stocks, particularly penny stocks, is not suitable for everyone and requires hard work, due diligence, capital, and substantial time to monitor the market and timely execute trades.