The global markets are getting destroyed … and plenty of active traders are feelin’ the pain.

Just look at a chart of the S&P 500 ETF TRUST ETF (NYSE: SPY). It’s been on a downtrend for months now…

If you ask me, here’s the biggest mistake I see newbies making: They’re taking the wrong trades.

But what does that mean? Can you tell if a trade is good or not before you know the result?

Of course YOU CAN.

And today I’ll show you the seven-step checklist I use to find the right plays.

It can even work in this tough-to-trade market.

Here it is.

#1: Float

This isn’t something most new traders take into account. I didn’t know how important the float was when I started trading.

It’s the number of shares the public can trade. You could also call it the supply.

All stocks have a float. But I’m interested in the ones with fewer shares. Stocks with smaller floats usually spike higher than stocks with larger ones.

That’s because, as demand increases, a small supply will make the price spike faster. It’s simple economics.

I look to trade stocks with a float of less than 100 million. Anything above that will have more difficulty moving.

#2: Volume

This determines how popular the stock is. The volume is how many times shares are traded back and forth.

Every time the volume trades the same amount as the float, it’s called one float rotation. I look for float rotation to confirm volatility. The more rotations, the better.

In terms of minimum volume, I’m looking for at least one million shares traded. Anything lower than that’s too illiquid.

Illiquidity means I may have difficulty finding people to buy and sell shares from. And let me tell you from experience … getting stuck in a volatile position is never fun.

#3: Catalyst

There needs to be a reason for the move. Here are a few examples that I see in the markets…

- Press release: Positive news about a company

- IPOs/SPACs: Companies that recently started trading are more volatile.

- Hot Sector: For example, the war in Ukraine is causing gas prices to jump. Oil and gas stocks are responding in kind.

- Sympathy plays: When there’s a big runner in the market, similar stocks may experience volatility as traders search for the next spiker.

If there’s no reason for the price to go up, I stay out of the trade.

#4: Price

Lower-priced stocks make bigger price moves than higher-priced ones. The percent gain is higher.

And because the price per share is so low, I can load up before riding the spike.

I usually scan for tickers valued at less than $5 a share. Those are the true penny stocks.

#5: Pattern

Day trading is all about identifying stock patterns to guess what will happen next.

For me to trade, I need to see a clean pattern developing on the chart.

There are tons of trading patterns out there. Try not to overwhelm yourself.

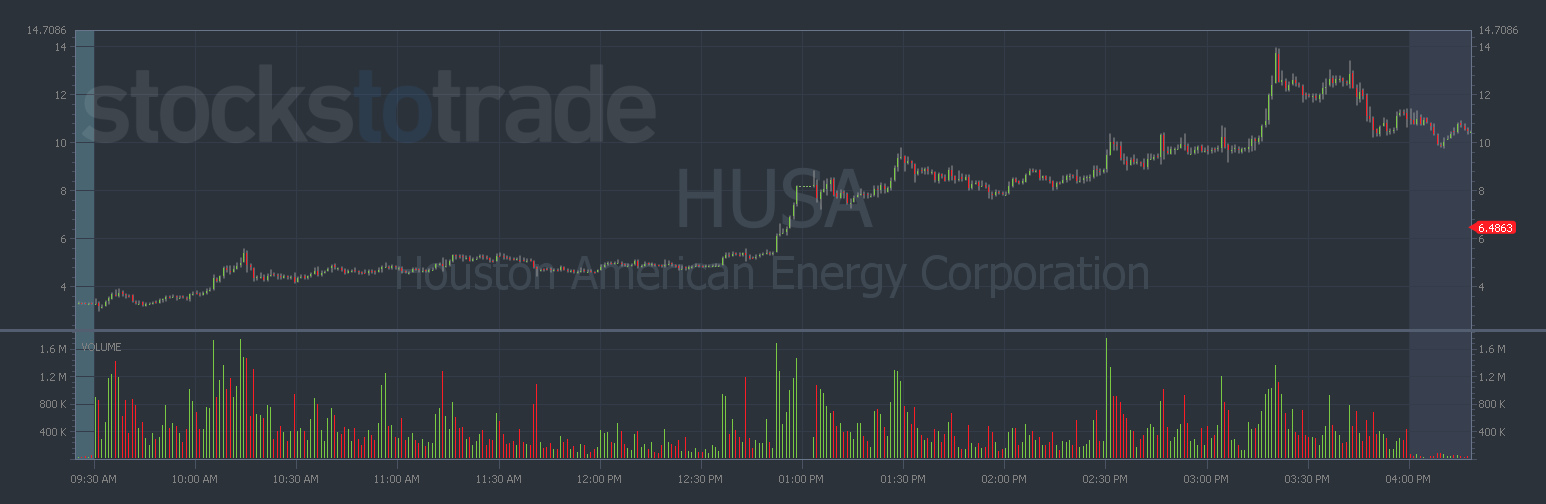

And I saw it on this recent runner. Houston American Energy Corporation (AMEX: HUSA) spiked more than 280% on March 7, 2022.

#6: Percent Gain

Stocks that are up more than 20% on the day can keep going. Remember HUSA?

Don’t try to get in on a play before it’s even moved. That’s gambling, and gambling will blow up your account.

I let a stock show me there’s volatility before making a trade.

#7: History

Stocks that have spiked before can spike again! This is one of the most important parts of trading.

Former runners often keep coming back. Don’t believe me? Check out this three-year chart of Gold and GemStone Mining Inc (OTCPK: GGSM)…

Live Trading Demonstration

I know that was a lot of information. Learning to day trade is a lot like drinking out of a fire hose, as my mentor Tim Sykes likes to say.

That’s why I hold live classes every Tuesday and Thursday with my students. They get to ask me questions, but more importantly, they get to learn the process as I’m trading.

You should come and check it out.

I’ll see you in chat!

Let’s get to work,

Roland Wolf

Editor, The Wolf’s Den