- See how two lines can predict TSLA’s (or any stock’s) price movement. Every trader should know this…

- Learn two great strategies to use with this trading indicator. (The first one’s my favorite.)

- Tired of taking the long way? This millionaire trader wants to share his $100K shortcut with you!

If you don’t use support and resistance lines when trading, you’re probably gambling. And that’s how most newbies blow up their accounts.

Day trading can be profitable, but you have to learn how to do it the right way.

All the best traders spent years studying the market and learning to use different tools and indicators. And one of the most important indicators to learn is support and resistance.

Keep reading and I’ll explain exactly what they are and how traders can use them. First, a quick announcement…

The $100K Shortcut?

Millionaire trader Mark Croock started in Tim Sykes’ Trading Challenge years before me. He’s an incredible trader and mentor with a wealth of knowledge. And now he has a strategy to share with traders just like you.

If you’re trying to grow a small account, I definitely recommend you check this out…Mark’s giving a special presentation on Monday, November 22, at 8 p.m. to share what he says is the ‘$100K shortcut.’ It’s no cost to attend — so sign up early. I know it’ll fill up fast.

Reserve your spot in Mark’s special event now.

Let’s get to today’s main topic.

Support and Resistance: What Are These Indicators?

Stocks like to bounce between invisible lines on charts. Those lines are support and resistance. (Read on and I’ll show you how to draw them in.)

Some stocks bounce pretty predictably, and some are more sloppy. This isn’t an exact science.

Most of the time, the lines are around whole-dollar and half-dollar levels. You could also call them psychologically significant numbers. Here’s an example…

Would you be more excited if a stock broke out over $5 or $5.37?

Most people will answer $5. It’s a nice whole number that registers with them. $5.37 seems arbitrary.

It’s not a perfect system, but support and resistance give traders an idea of…

- Where a stock is headed…

- Where it might reverse directions…

- And where it might break out.

Example of Support and Resistance

It’s probably easier to see this on a chart before I explain more. It can be a little difficult to understand unless someone shows you.

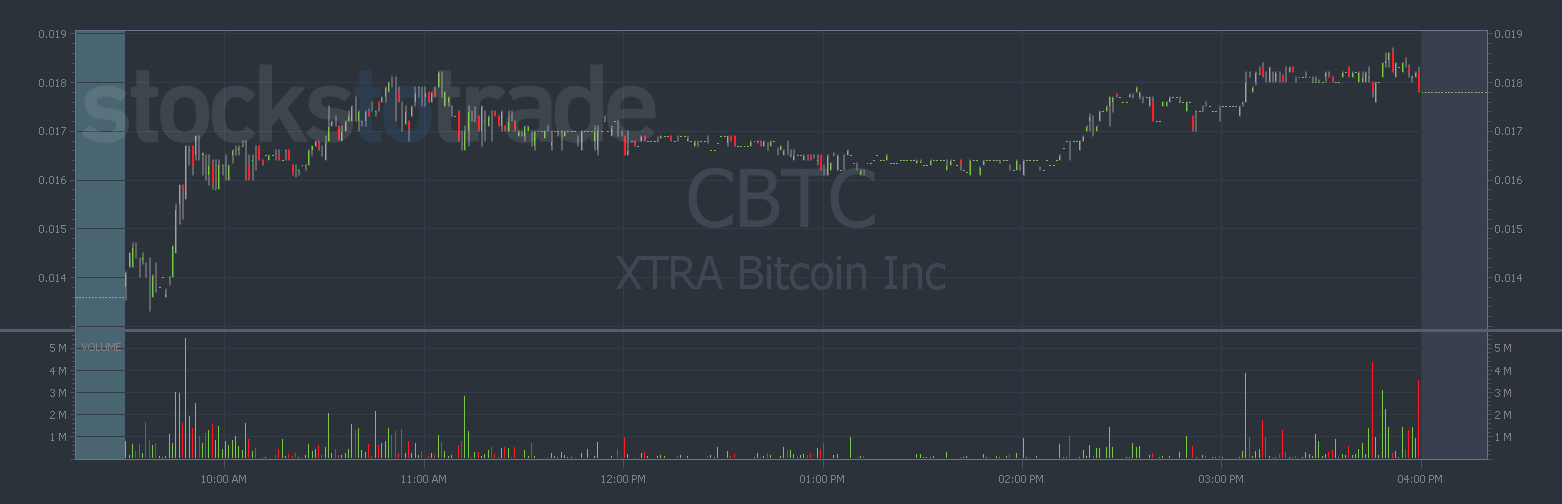

Check out this intraday chart of XTRA Bitcoin Inc. (OTCPK: CBTC) from October 20, 2021. The first chart has no support and resistance lines added.

To the untrained eye, this might look like any other random stock chart. But I can see clear resistance at $0.016. The stock breaks through, bounces between $0.016 and $0.017, breaks through again, and then fails at $0.018.

Throughout the day, it slowly sinks back to $0.016 support and then tries for a sketchy breakout of $0.018.

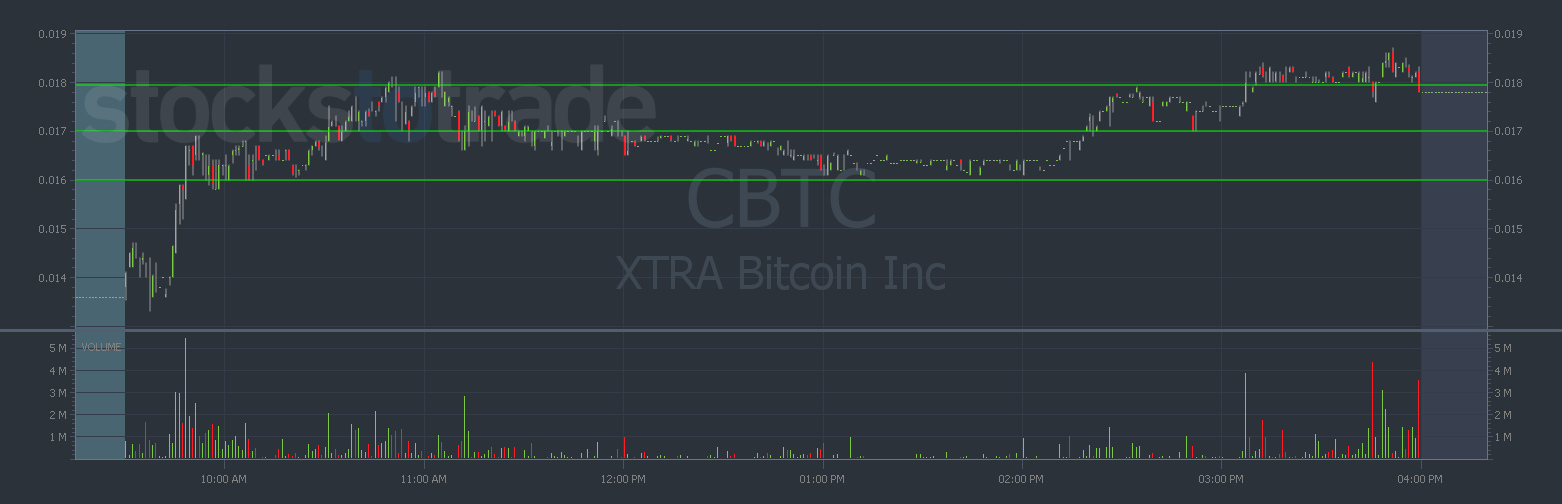

Check it out on the chart below. I drew in the lines to help you out.

The stock peaks above and below the levels a bit. Remember how I said it wasn’t an exact science. Now it’s time to learn…

How to Use Support and Resistance

These lines can be helpful in many different trading strategies. I’ll share two with you today…

Gap and Crap Reversal

You may already know that I like this pattern a lot. I’ve covered it countless times. But essentially, I’m looking for the stock to gap up in the premarket.

Then, when the market opens, ideally, it’ll dip and put in a double bottom before retesting premarket highs.

The double bottom indicates a strong support level for the stock to jump off of. That’s where I look to buy.

Breakout Trading

Local highs and all-time highs are automatic lines of resistance. It’s difficult for stocks to reach new highs because…

- Shorts try to push them down

- And any bag holders sell into strength

So if it manages to break out, it’ll be on a lot of volume. And the move could go parabolic.

Traders looking to ride a breakout move will usually buy on dips above support. Then they sit back and wait to see if it’ll go higher.

For both of these strategies: cut the loss if it breaks through your support. Always trade with a plan.

Breakout Trade on TSLA

No, I wouldn’t try to day trade a breakout strategy on Tesla Inc. (NASDAQ: TSLA). There just isn’t much meat in the move to take. The price is so high now that its percent gains are minimal.

But I want to demonstrate the power of the support and resistance lines, even on big stocks like TSLA.

Here’s the chart from October 20, 2021, without any added lines. Do your best to visualize where the lines might be and consider why.

Remember what I said about whole-dollar/half-dollar levels? When stocks trade at prices as high as this you can use tens and fives.

For example on this chart, I drew lines at $860 and $865. See how the price reacts around the lines?

Again, it’s not an exact science.

But you can see it put in a base around $860 at 9:55 a.m. Eastern. Then it continued to consolidate and make higher lows until the breakout and bounce off of $865.

Remember, riding this stock from $860 to $869, which would be a perfect trade, is only a 1% gain.

That’s why I don’t day trade high-priced stocks. But I want you to see that you can put these lines on any chart.

Send in Your Questions on Key Levels

Don’t stop studying here!

Use this information to further your education.

Now that you know about these valuable trading indicators, go look for evidence of them in the market.

Still not clear? Email me. Click the button below to submit your support and resistance questions. I’ll answer your questions in an upcoming edition of this newsletter.

Answer My Support & Resistance Question

In the meantime, start using this information to work toward getting better.

The trading journey is a marathon, not a sprint. Do what you can today to better prepare for tomorrow.

One step at a time,

Roland Wolf

Editor, The Wolf’s Den