It’s a tough time for the markets right now.

If you keep losing on trades, don’t beat yourself up.

I’ve been in this niche for 5 years. And this is one of the toughest markets I’ve seen for trading.

But it’s not hopeless!

Even during bear markets, there are volatile stocks to watch.

And everyone’s got eyes on the energy sector.

Source: Wall Street Journal

These are the lower priced plays I’m watching …

Energy Stocks

There are 3 main factors pushing energy stocks higher …

- Inflation

- Limited Supply

- Sanctions

Whichever way we look at it, the cost to produce energy is going up.

And companies that navigate price hikes successfully will come out on top.

Take Shell PLC (NYSE: SHEL) for example. It reported highest quarterly profits since 2008 because oil prices are higher. This means consumers pay SHEL more money for gas.

But I don’t trade stocks like SHEL. I prefer lower priced plays because they are more volatile.

And more volatility means I can take more profit.

Here are the 5 energy stocks on my watchlist …

- Nine Energy Service, Inc. (NYSE: NINE)

- Vivakor, Inc. (NASDAQ: VIVK)

- U.S. Well Services, Inc. (NASDAQ: USWS)

- Houston American Energy Corp. (NYSE: HUSA)

- U.S. Energy Corp. (NASDAQ: USEG)

Want to know how I found them? Keep reading …

My $1 Million Scan

It doesn’t cost $1 million to run.

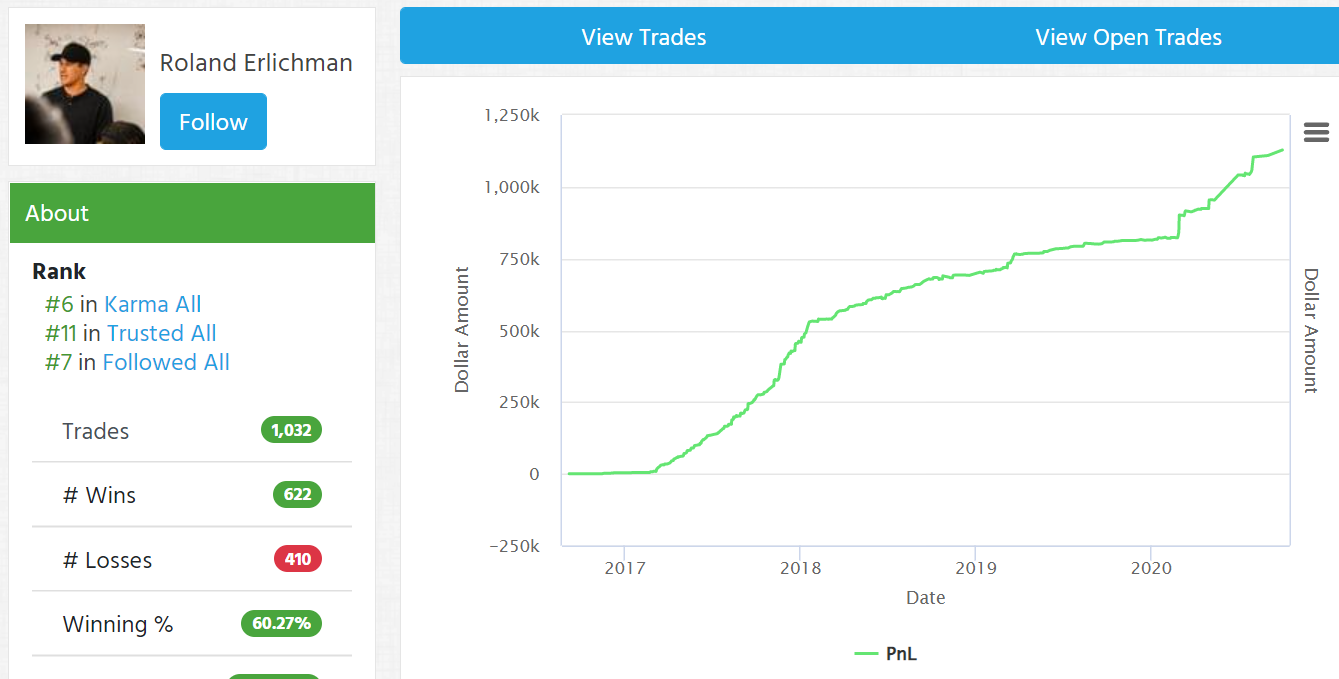

I call it my million dollar scan because I used it to make over $1 million in trading profits.

Source: Profit.ly

And I still use it today to find hot stocks.

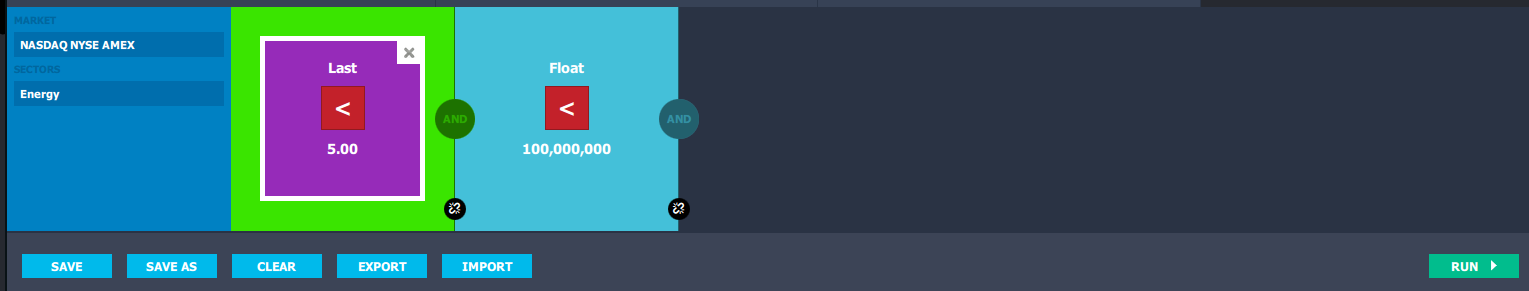

Here are the main factors. I’m looking for …

- Listed stocks. Sometimes I play OTCs but lately there haven’t been great opportunities.

- Less than $5. Lower priced stocks have higher percent spikes

- Float less than 100 million shares. Lower supply of shares means more demand will spike stocks higher.

- History of spiking. Stocks that ran in the past can run again.

This is a screen shot of my scan …

Source: StocksToTrade.com

Then I scroll through the stocks for past spikers.

Take USWS for example …

USWS chart 2 years, 1-day candles Source: StocksToTrade.com

In this niche, I need up to date information to compete against other traders. And free stock scanners aren’t good enough.

So I use StocksToTrade. I can create quick and easy scans for hot stocks and there are tons of other features too. Like broker integration, breaking news scanner, and the Oracle volatility scanner.

It’s the one stop shop for day traders looking to make big profits.

Because you’re one of my students, I’ll share this link with you …

Are you serious about day trading? So are all my students.

Join me us for a live trading webinar.

Or better yet, come meet me in person! Tim Sykes and I are going on tour to hold live and in person trading events.

Get in on the action,

Roland Wolf

Editor, The Wolf’s Den