Happy Memorial Day!

The market’s closed … But I want to make sure you’re prepared for the upcoming trading week.

That’s why I’m getting my weekly watchlist out to you now.

The overall market bounced big last week, with the S&P 500 gaining about 8%. I’m expecting the bullish trend to continue.

Plus, I’ve discovered six stocks that have a chance to go beast mode!

Here are the six stocks I’m watching for profit opportunities …

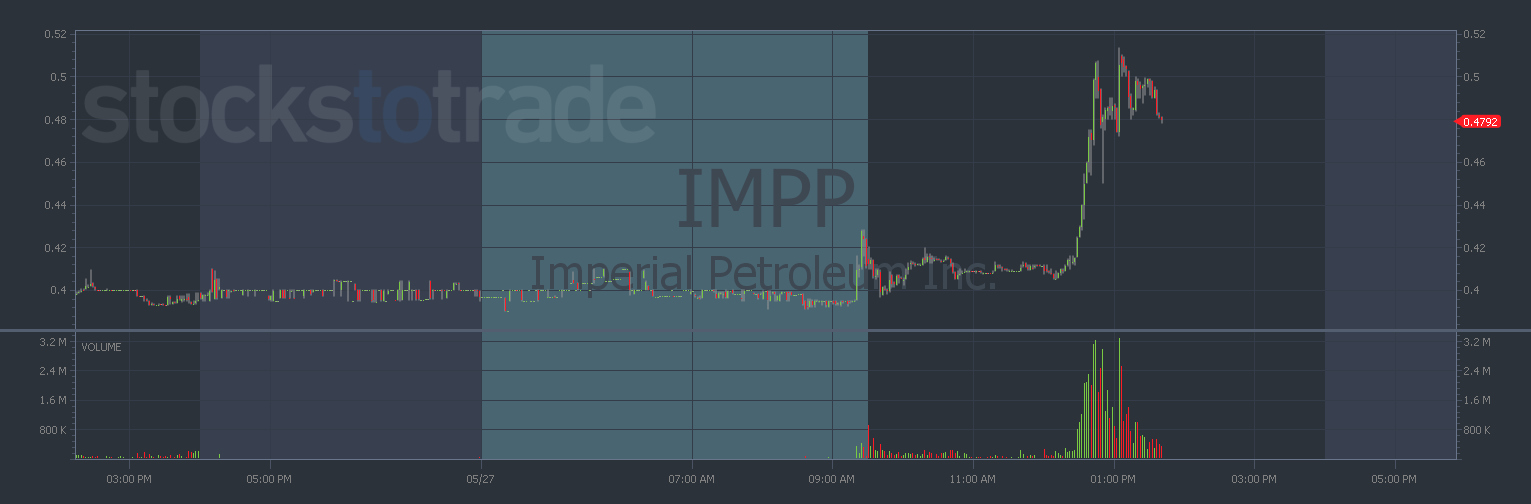

#1: Imperial Petroleum Inc. (NASDAQ: IMPP)

Check out the history of spiking for this stock …

That’s the kind of volatility that traders can profit from.

This is a past runner in the oil and gas sector. And it woke up halfway through the trading day last Friday.

I’m watching it for any secondary moves with volume.

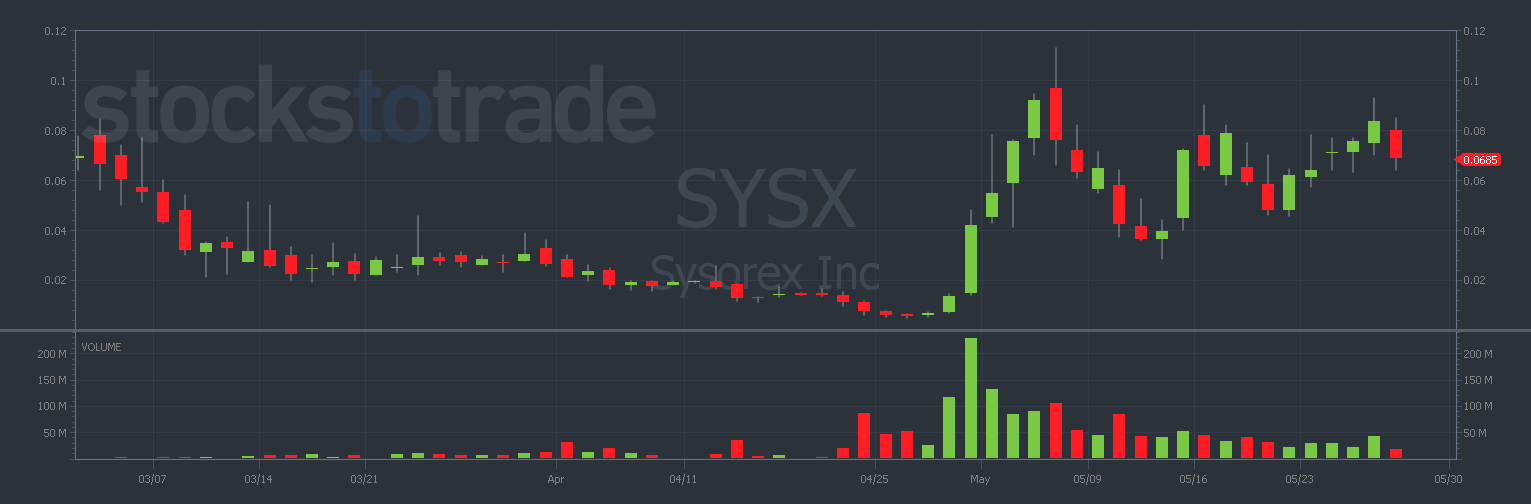

#2: Sysorex Inc (OTC: SYSX)

I haven’t been trading OTC stocks much recently.

There aren’t as many penny stock plays right now, so I’ve been sticking to listed stocks.

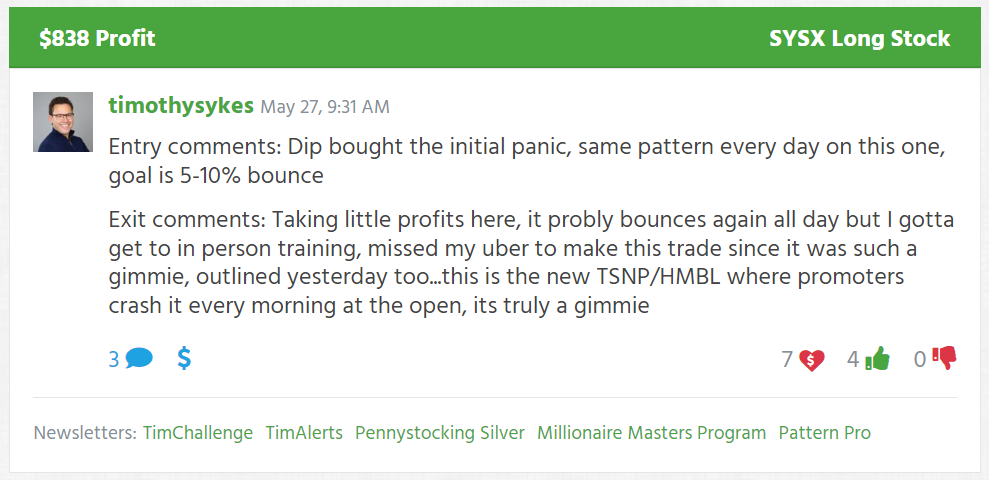

But in the last month, my mentor Tim Sykes has made over $4,000 in profits on this stock alone.

Here’s one of his trades …

Source: Profit.ly

It never hurts to find out what’s working for other traders.

If Sykes keeps finding opportunities to profit, it’s worth a watch.

Speaking of different profit opportunities … Another one of Sykes’ students has an awesome profit strategy. He’s made over 6 figures in 24 hours with it!

I already reserved my spot for Mark Croock’s Shadow Trades Summit. It’s on June 2 at 8 p.m. Eastern.

Will I see you there? Sign up right here!

Now that you’re signed up, let’s get back to SYSX …

It’s been on the move since late April.

I don’t know if it’ll break out. But Sykes is trading it during this consolidation period, so there are clearly a few ways to play this stock.

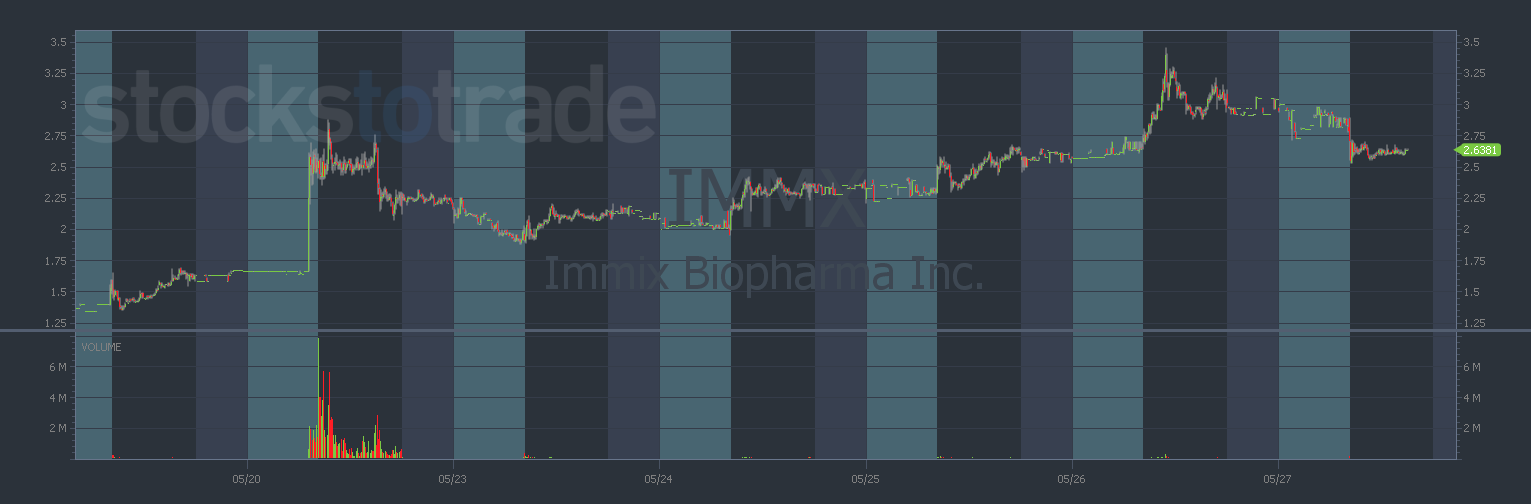

#3: Immix Biopharma Inc. (NASDAQ: IMMX)

This is a low-float biotech that’s been volatile for a few days.

Right now it’s testing support at the $2.50 level.

If it moves for a breakout … I’ll be ready to catch it.

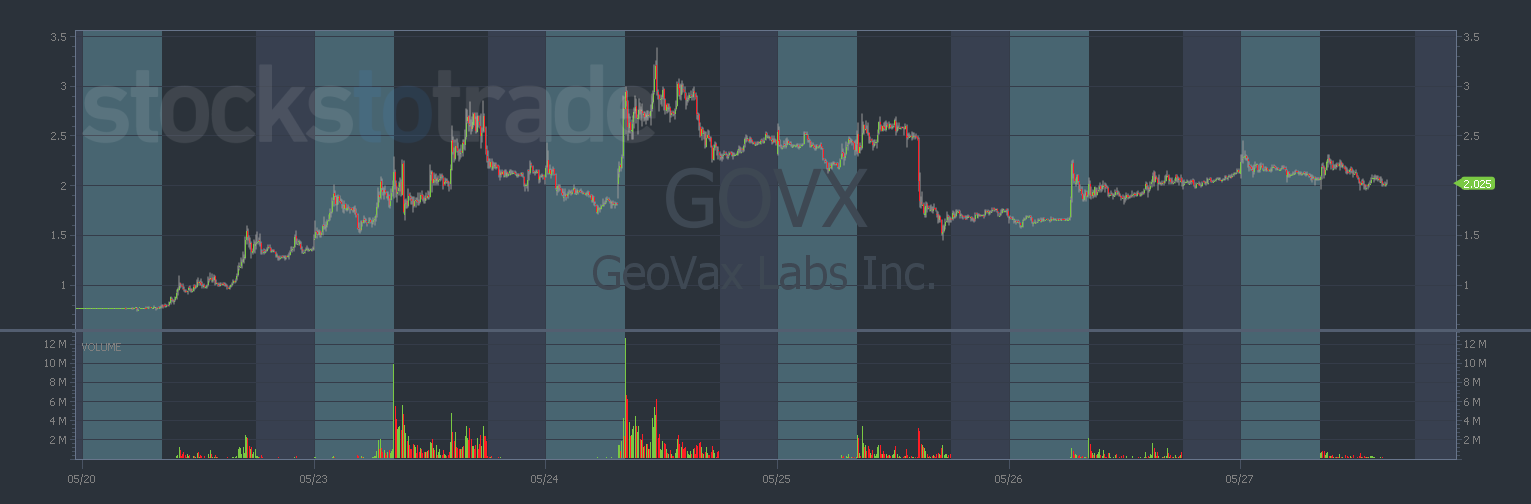

#4: GeoVax Labs Inc. (NASDAQ: GOVX)

Another volatile biotech stock!

This one’s testing the $2 level.

And it’s actually a really good example of sector momentum.

Sometimes stocks in the same sector will run. Seeing a lot of biotech runners is a hint that maybe we should be looking for more biotech stocks.

#5: BlackSky Technology Inc. (NYSE: BKSY)

This stock announced government contract news last Wednesday.

And it might break out as I’m typing this. Take a look at the chart …

The float is under 100 million, and that’s a good sign.

When it comes to trading stocks, low supply means the price will spike faster.

What do I mean by ‘low supply’? Any stock with a float of fewer than 100 million shares.

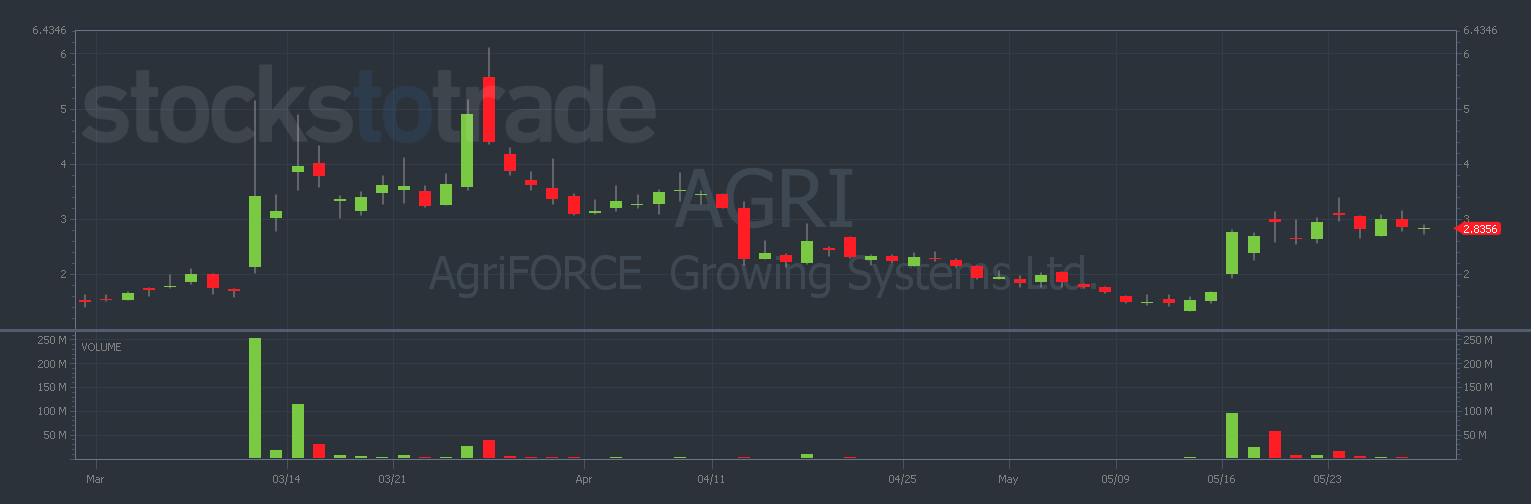

#6: AgriFORCE Growing Systems Ltd. (NASDAQ: AGRI)

Speaking of low floats … this stock only has 13.2 million outstanding shares.

And that’s way below 100 million.

Plus, it’s a former runner from April 2022 and it’s currently consolidating around $3.

I’ll be ready if it spikes higher.

Use This Pattern

It’s not enough to know which stocks are in play. You’ve gotta know how to play them.

There are a bunch of different patterns out there you could choose from. If you’re new, you can try using my favorite one. Here’s a video about it …

But if you’re serious about trading, take it one step further…

Join my students and me for a live webinar. You’ll get to see my screen and ask questions as I’m trading!

Take your dreams seriously,

Roland Wolf

Editor, The Wolf’s Den

P.S. My mentor Tim Sykes and I have decided to team up for a special in-person live training tour. Click here for the cities and dates.

All content in this newsletter is intended for educational and informational purposes only.

The material in this newsletter is not to be construed as (i) a recommendation to buy or sell stocks, (ii) investment advice, or (iii) a representation that the investments being discussed are suitable or appropriate for any person. No representation is being made that following The Wolf’s Den’s strategies will guarantee a particular outcome or result in profits. The price and value of stocks may fluctuate depending upon various market factors, and, as such, the strategies used by The Wolf’s Den to adjust for those fluctuations may change without notice.

There are significant risks associated with trading stocks and you must be aware of those risks, and willing to accept them, in order to invest in these markets. Past performance of any trading system or methodology is not indicative of future results. You should always conduct your own analysis before making investments.

You should not trade with money you cannot afford to lose and there is a risk that trading stocks will result in a complete loss of your investment. Trading stocks, particularly penny stocks, is not suitable for everyone and requires hard work, due diligence, capital, and substantial time to monitor the market and timely execute trades.