Welcome back to the Wolf’s Den,

There are times I trade, and times to sit on my hands.

Right now, it feels like trading time…

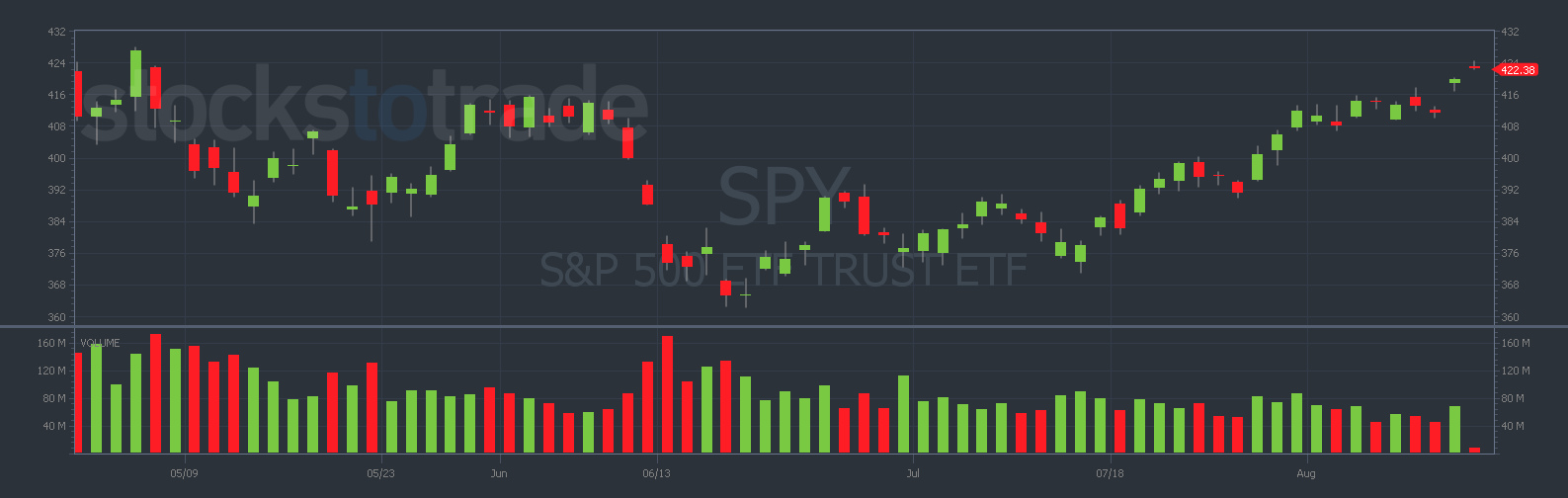

The markets responded positively to a lower CPI inflation numbers for the month of July. Check out this chart of the S&P 500 ETF Trust (NYSE: SPY), it broke out to 3-month highs!

SPY chart Source: StocksToTrade

It also happens to be earnings season…

One of the most valuable things I learned from Sykes: at certain times of the year, there are more potential spikers. That’s when I get more aggressive.

We’re in one of those times right now.

And if you were watching the charts yesterday, you could’ve snagged a huge runner during lunch break.

This #1 stock proves the amount of opportunity right now.

Keep reading to see this spiker. And I’ll show you how to find more…

How To Catch Earnings Winners

Four times a year, listed companies have to disclose financial reports. And a lot of companies report their earnings around the same time.

This is called earnings season.

And it causes a lot of profitable volatility…

This is why I love trading as a side hustle. Technically I’m a full-time dad, I just trade on the side.

And I’m able to split my time so easily because the stocks in this niche are so predictable.

Want to be alerted to hot trade ideas before anywhere else?

Breaking News Chat is the alert service that traders can’t get enough of. Two former financial analysts scour the stock market and news for stocks that could potentially spike and alert the room allowing you the chance to get in on the action.

Check out the alert for AERC on August 9th:

This is a tool you’ll want in your trading toolbox.

Maybe you don’t have a lot of time to trade … it doesn’t take much time to profit off these runners.

Let me show you this example…

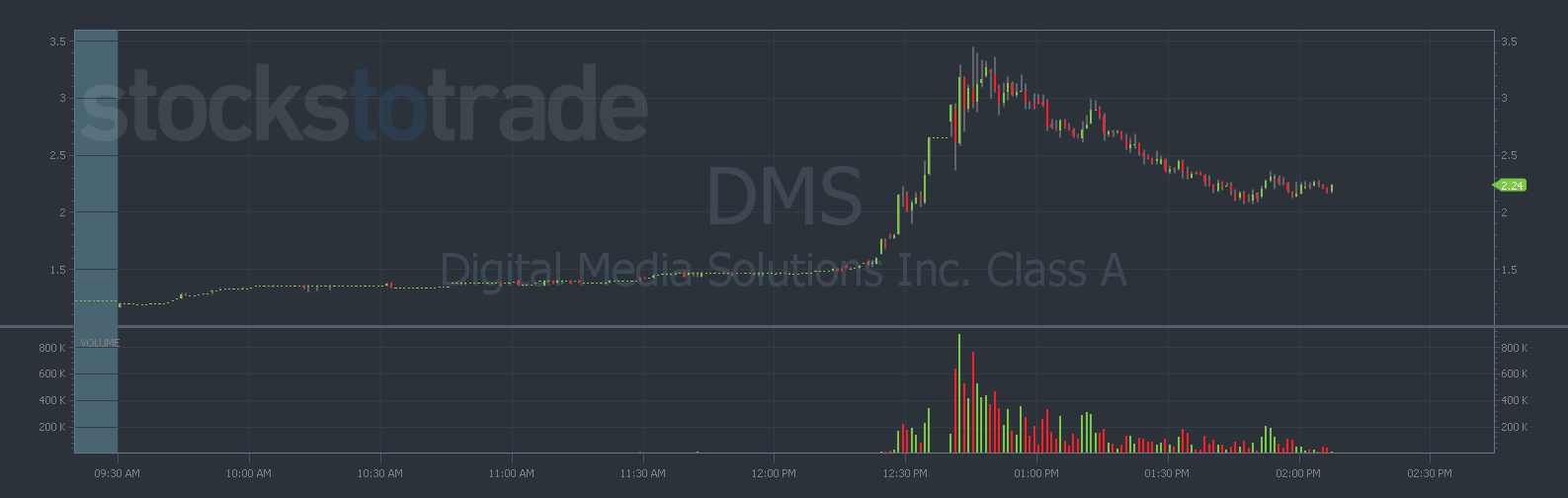

Digital Media Solutions Inc. (NYSE: DMS)

For the last month and a half, this stock lazily traded below $1.50.

But on August 10, 2022, they released financial results.

The price pinged around for a day. Then, on August 11, 2022, just after 12 p.m. Eastern, it spiked 130% in less than an hour.

Here’s a chart…

DMS chart Source: StocksToTrade

This thing could bounce off $2 support and continue the spike…

But my main point is the size of the first spike.

The opportunity is crazy here. You could go for a lunch break, slam a yogurt, nail an earnings winner, and then get right back to your day job.

Here’s How…

I got into stock trading to make money. And I was determined to win.

Tim Sykes saw that, and his team let me join the crew.

He’s got the best track record of any trading mentor I’ve seen. I think it’s because he cares more about teaching than trading.

His whole team is focused on creating as many millionaire traders as possible … and they’re off to a great start.

Check out this video … it explains everything you need to know about these spikers.

That’s not Tim Sykes, it’s one of his buddies, Tim Bohen. I’m telling you people, this community is huge! And they’ve got so much good content.

I asked Sykes to give my readers a chance to discover his trading secrets…

Don’t give up this opportunity!

This is not the time to slack,

Roland Wolf

Editor, The Wolf’s Den

P.S. Too many times, students join Sykes’ after following the wrong mentor. They get taken advantage of, and we’re too late to help them. Don’t get led astray … this is the path to profits.

All content in this newsletter is intended for educational and informational purposes only.

The material in this newsletter is not to be construed as (i) a recommendation to buy or sell stocks, (ii) investment advice, or (iii) a representation that the investments being discussed are suitable or appropriate for any person. No representation is being made that following The Wolf’s Den’s strategies will guarantee a particular outcome or result in profits. The price and value of stocks may fluctuate depending upon various market factors, and, as such, the strategies used by The Wolf’s Den to adjust for those fluctuations may change without notice.

There are significant risks associated with trading stocks and you must be aware of those risks, and willing to accept them, in order to invest in these markets. Past performance of any trading system or methodology is not indicative of future results. You should always conduct your own analysis before making investments.

You should not trade with money you cannot afford to lose and there is a risk that trading stocks will result in a complete loss of your investment. Trading stocks, particularly penny stocks, is not suitable for everyone and requires hard work, due diligence, capital, and substantial time to monitor the market and timely execute trades.