- Learn what I’m looking for in 2022…

- I might be trading more conservatively. Find out why and how …

- Is Elon revolutionizing a $23 trillion market?? Check out this HUGE news!

In my last letter, we reviewed some lessons from 2021. Now it’s time to apply them going forward.

This is how you become a millionaire day trader. It’s all about the mindset.

You must learn from the past to better influence your future. There will be many opportunities to profit in 2022. I have no doubt.

But you have to be patient enough to make the best plays. Here’s how I’m approaching trading this coming year…

What’s New

I’m breaking this letter into 2 parts: what’s new and what isn’t. First on my list of new trading tips…

Catalysts

They come and go. And every so often we get some new ones. Going into 2022, I’m looking for buzzwords like …

- Crypto

- NFT

- Metaverse

- Electric vehicle (EV)

These are some words that penny stock companies have been using to pump their prices lately. Keep an eye out for newsletters and SEC filings trying to capture sector momentum.

Reading SEC filings is pretty boring. But they can hold ‘secret’ gems of information for traders. I learned from Sykes. My best advice is to grind through this DVD. It has everything you need to know.

Market Conditions

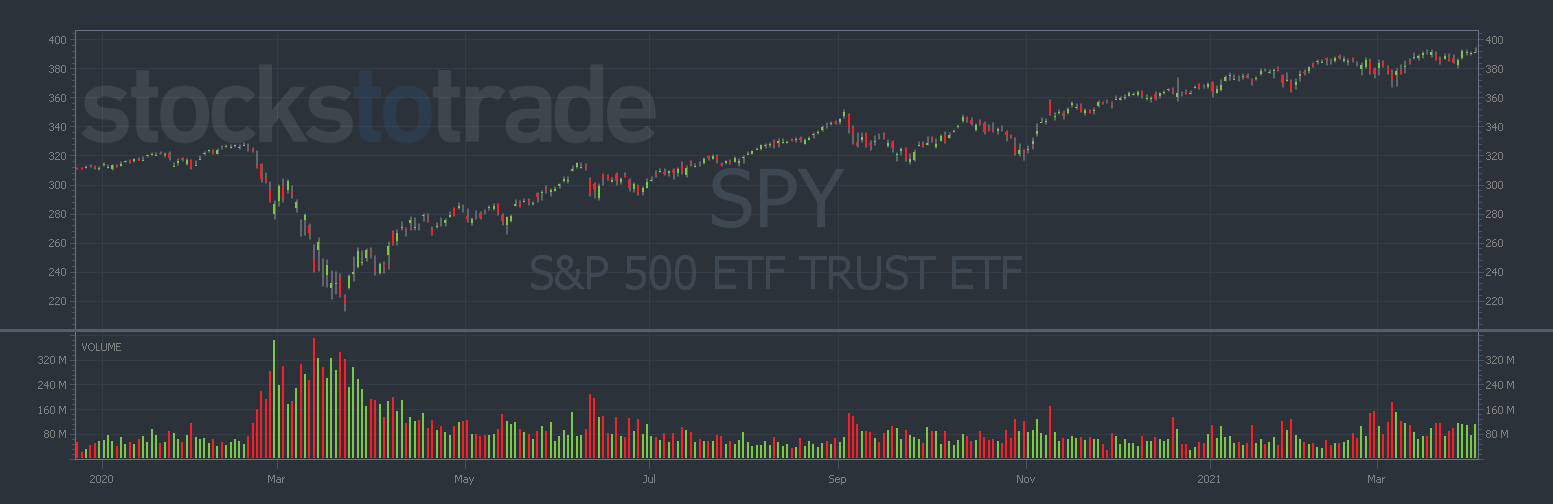

This time last year, the market was rebounding successfully from lockdown lows. It even ended up breaking out and running higher.

Check out this chart that shows the S&P 500 ETF Trust (NYSE: SPY) chugging higher through the beginning of 2021.

A lot has changed since last year. The market’s still up … but there are rumors that a crash is coming.

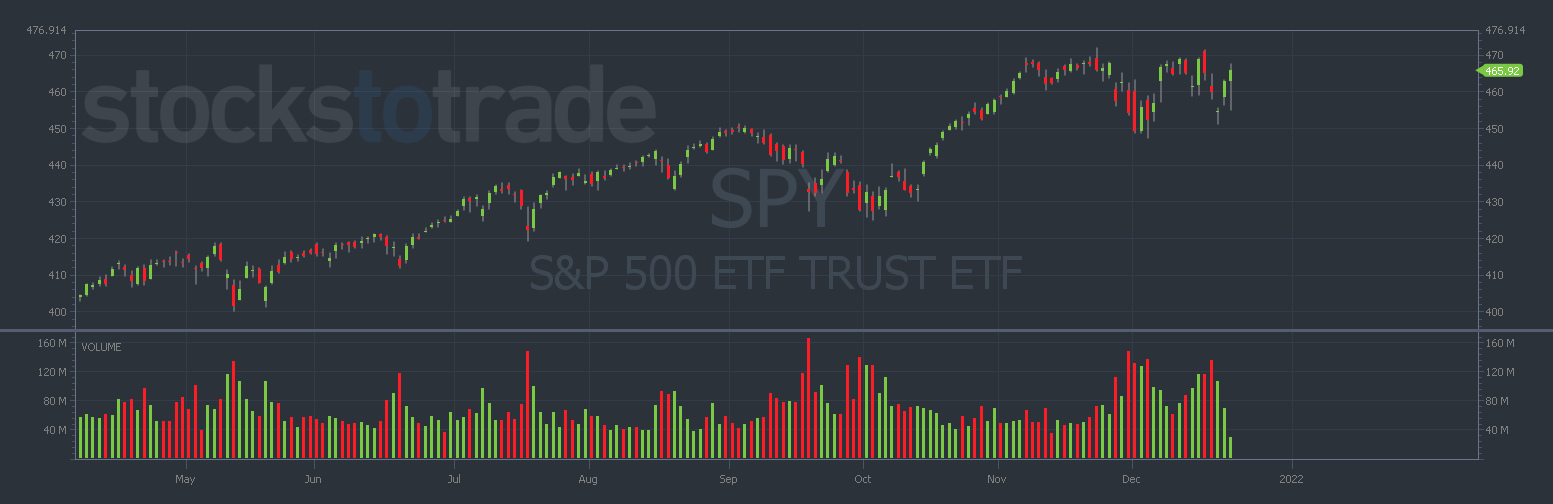

Take a look at the market lately. It’s struggling to break above highs around $470.

With that in mind, I’ll start to trade a bit more conservatively. Keep reading to learn how…

Some Things Stay the Same

With catalysts and market conditions still in mind, here’s what I’m relying on…

Catalysts

With catalysts, there will always be good ones and bad ones. Some work and some don’t. You can tell the difference if you take the time to watch and learn. The fundamentals of stock trading still apply. Check for these factors…

- Attention-grabbing news

- Added value

- Avoid fluff

- No news? No trade.

Market Conditions

When stocks are slow, it’s time to protect gains.

- Size down

- Cut losses quickly

- Focus on the best plays

- Sit on your hands

Market crashes can be scary if you don’t know what you’re doing. Make sure you put in the time studying now. That way you’re prepared no matter what happens.

Final Thoughts

My best advice is to treat this new year like any other year. Stay on your toes and only focus on the best plays looking for:

- Volume

- Catalysts

- Patterns

That’s what it all comes down to. Don’t think about the profits. Instead, dedicate yourself to the process. Focus on making the best and safest trade you can.

Stop thinking about the money. It’s sort of like that saying…

A watched pot never boils.