- The top things to know from last week’s trading action.

- Is the market slowing down? How can we tell? Here’s how to stay ahead of the game…

- Grow your account 5x in one month? This trader wants to show you how he did it!

Welcome to the second week of 2022! Let’s take a look at the action so far…

To stay profitable it’s essential to understand this market environment. It’s always changing.

Recognize what’s working and what isn’t. Otherwise, you’re trading blind. For example … how do you know which catalysts to pay attention to if you don’t know which spike stocks.

Study Tip: Watch this DVD to find the right stocks before they spike.

Today, we’ll go over last week’s market to prepare for more January trading.

What’s Working

Early last week, I saw listed biotechs running again. Biotechs have actually been popping up for a few months now. When you’re scanning for hot stocks, pay attention to the sector.

For me, it all comes back to sector momentum. If the same kinds of stocks keep spiking, that’s a hint. I’m not saying buy every biotech penny stock. But if a mover happens to be in the sector, there’s a greater chance it’ll spike.

I’ve also noticed a lot of $1 runners, like ATA Creativity Global (NASDAQ: AACG). There wasn’t any news to push it, but I’m seeing more moves like this.

Going forward I’ll pay attention to…

- Biotechs

- Stocks trading around $1

- News

Trading stocks with news is non-negotiable. I know I just said biotechs and $1 stocks have been running. But it doesn’t mean they all will. Focus on the best plays.

Stay Skeptical

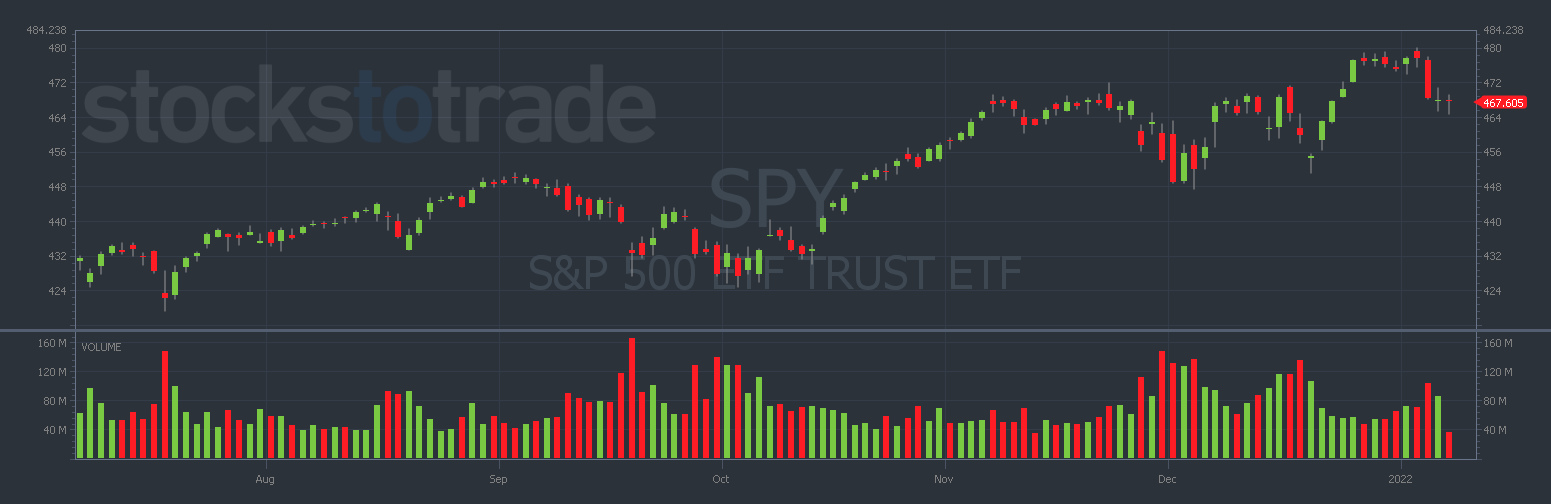

Toward the end of the week, I recognized some market weakness. Take a look at a chart of the S&P 500 ETF Trust ETF (NYSE: SPY). It tried breaking out over $480 but failed and dropped back down.

It’s not something to worry about. The markets pull back every now and then to offset growth. It’s kind of like taking a break. The hot market will come back someday, and I’ll be ready when it does.

In the meantime, to protect my account in a slow market I might size down a bit. I’ll also cut losses more quickly and take profits sooner.

I don’t know when it’ll heat up. It could be this week, next week, next month … no one knows. The important part isn’t guessing the next hot market. It’s understanding the market you’re in now.

The future will take care of itself. My job as a day trader is to wake up every day and prepare to protect my account.

Take it one trade at a time.

What’s Not Working

To finish this letter on a strong note I’m including a failed trade from last week. This is a perfect reminder that every trader loses at some point. It’s part of the process.

But I was able to control my losses to trade another day. That’s how a pro does it.

I took a few hundred dollar loss on Eargo Inc. (NASDAQ: EAR) on Thursday, January 6. The stock spiked in premarket after an SEC filing stated the company was no longer under criminal investigation. Sounds like good news to me.

Study Tip: Watch this DVD to prepare for future catalysts. Companies hide a lot of juicy information in SEC filings.

I bought it in the afternoon and got stopped out after a price drop. I was happy with the trade because the stock didn’t break out later in the day. The next morning it actually gapped down a bit and continued falling.

My risk level kept my account safe and I was able to cut my losses quickly. In my book, that’s a great trade.

Control losses to control profits,

Roland Wolf

Editor, The Wolf’s Den