- Learn what inflation is and how it impacts stocks.

- Should you worry about the newest inflation metrics? Let’s dig into it.

- Ready to speed up your learning curve? Get in this program!

The U.S. economy is currently experiencing the highest inflation rates in three decades. Now’s a good time to cover what that means for stocks.

It’s essential for day traders to pay attention to the world as a whole. You might like to hunker down in your basement and only watch stocks … but world events influence the market.

(Also, that lifestyle doesn’t sound very healthy.)

Back in the 1970s and 80s, high inflation rates affected the stock market dramatically. Now we’re seeing lots of headlines and warnings about our current inflation rate.

Let’s see what it means for traders like us…

What Is Inflation?

The yearly inflation rate is the percentage that prices have risen from the previous year.

It’s important to understand that inflation is a good thing. A low inflation rate shows that the economy is growing. But if inflation is too high, it can have negative repercussions.

A ton of factors can cause inflation…

- Increased production costs

- The Fed printing excess money

- Labor shortages

Those are just a few. But if you notice, these are all factors pushing U.S. inflation higher.

Oil and gas prices are going up, which means production costs will increase for most businesses. Stimulus packages mean more money circulating in the economy. And we’re still having trouble getting laborers to come back to the workforce.

Bottom line: inflation has increased due to several factors.

What Does That Mean for Stocks?

Let me preface my analysis by saying that anything can happen in the stock market.

As a day trader, I’m looking for clues to help me predict movements. It’s not a perfect system, and I can still be wrong.

That’s how trading works.

Like I said before, a bit of inflation is good. Stock prices go up as businesses make more money and the whole economy moves forward.

But if inflation is too high the opposite will happen.

If prices rise too much, businesses start to feel the negative effects. They pay too much money for production costs AND consumers balk at their now higher-priced goods. It’s a sticky situation.

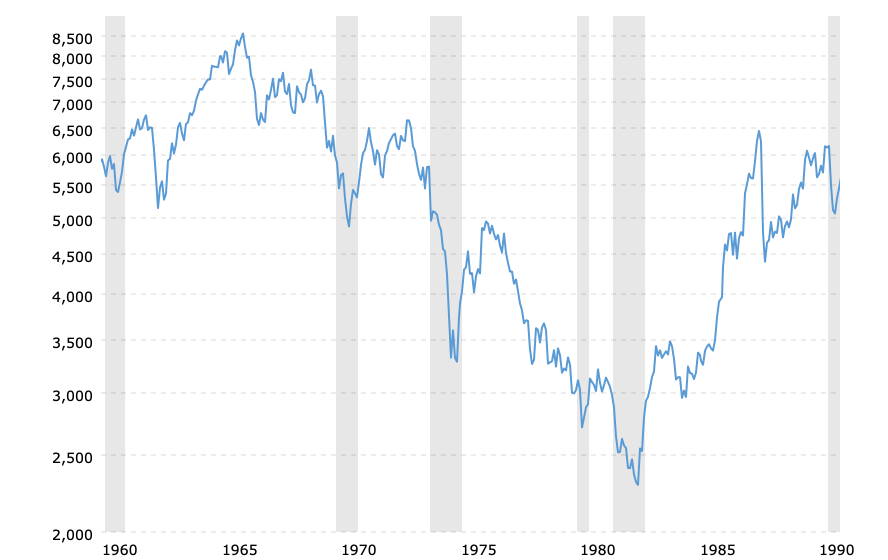

For example, back in the 70s and 80s, inflation rates were so high that stock prices began to fall.

Check out this chart that shows the Dow Jones Industrial Average (NYSE: DJI) from 1960–1990. The price dropped by more than half.

The inflation rate in some of those years was above 10%. That’s pretty big. For reference, the inflation for October 2021 was 6.2%.

Is Inflation High Now?

Yes. Many think the current rate is a bit concerning. There were years in the 70s that experienced a rate of 6%.

But there are reasons to be optimistic…

- While 6% is a little alarming, it’s still manageable. At least it hasn’t spiked above 10%.

- The inflation rate is not the only stock market influencer. Other market positives could outweigh a high inflation rate.

- There are always runners. You just have to be extra careful in fragile market conditions.

- The market has always rebounded. Check where DJI trades today.

Anything can happen.

Don’t let high inflation keep you out of the market. Just understand the inherent risks due to our economic environment.

Make sure to stay up to date on this information! If the rate continues to rise we may have a problem on our hands…

Final Thoughts

Understand the relationship between economic events and the stock market! I can’t stress this enough.

Being prepared puts you ahead of the game. It’s that simple.

If you want to be a self-sufficient day trader, start educating yourself.

- Read books

- Google definitions and news

- Take classes

- Get curious

You can’t expect success by putting in minimal effort. I hope you understand that.

That’s all for today.

Reminder: Check your inbox every Monday and Wednesday for more TWD content!

Choose to try your best,

Roland Wolf

Editor, The Wolf’s Den