- What I look for when swing trading (and the ONLY time I buy)…

- Would I trade QLGN? Find out now…

- Want to cut down your learning curve? Check out the tools that can give you more confidence in your trading!

Lots of traders dream of swing trading. Many think it’s as easy as entering a position before the market closes, then waking up to a nice overnight profit.

Spoiler alert: nothing’s that easy. If it were, everyone would be doing it. There are a lot of variables that go into swing trades. And if you get it wrong, the results could be disastrous.

Let’s run through what a perfect swing trade should look like. Plus, one of you sent me a great question about this topic. So keep reading to get the answer…

The Swing Trade

First, the basic rundown…

A swing trade is when a trader buys (or short sells) a stock and hopes to exit their position the next day with a profit.

Sometimes swing trades last longer than one day to the next, but that doesn’t matter much. Just know that the longer you hold a position, the riskier it can get.

This is a pattern anyone can learn, but getting it right takes a lot of practice.

Here’s what I look for in a good swing trade …

- The stock has recent news/catalyst. There needs to be a good reason for the move. If the stock is up for no reason, why would anyone buy it overnight for a gap up? Find evidence.

- High volume. This shows people’s interest in the stock.

- Lack of upward resistance on the daily chart. If there are recent bag holders, any move higher will get stuffed by sellers.

- The intraday chart consists of a morning spike, then sideways price action.

- It doesn’t break out in the afternoon. The idea is to buy above support but below the breakout level. If the stock pushes through intraday highs in the afternoon, sellers will take advantage of that bullish action and stuff the stock. That means no gap up the next morning.

Check out this helpful example…

Look at QLGN

Before I pull up a chart, I’d like to introduce a question from one of my readers. Thank you so much for sending this in, Bill. Your question lines up perfectly with today’s lesson. Bill asks:

“I’ve noticed in some recent closings of several stocks over the last two weeks (particularly QLGN) that there has been some nasty shorting/pulls right at closing. Do you think that this is market manipulation? Almost seems too drastic to be some shorts making a killing. Thanks.”

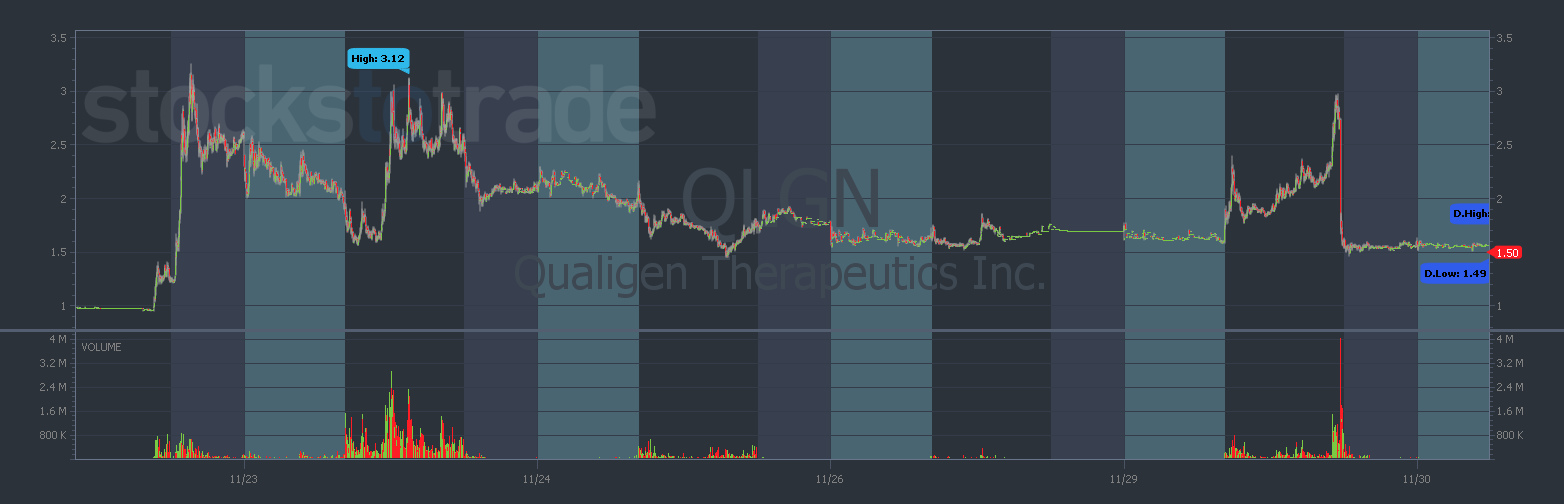

Let’s look at Qualigen Therapeutics Inc. (NASDAQ: QLGN). We’ll treat it as a swing trade. Bill might not have been looking to trade it, but just in case, let’s go over it.

Does the Stock Have Recent News/Catalyst?

It originally spiked on November 22 in the afternoon. No news.

I think Bill is referring to November 29 in his question. But there wasn’t any news for the initial spike. The move on the 29th is purely a short squeeze. Is it market manipulation? More on that in a bit. What I see here is dangerous volatility. Stay away.

Let’s dive in deeper…

Is There High Volume?

There were a good number of shares traded that day — just under 100 million. The stock’s float is only 28 million. That means the stock rotated its float about three times.

That’s what you’re looking for when it comes to volume. But in this case, there wasn’t enough volume. Keep reading to see how I know that…

Is There Upward Resistance on the Daily Chart?

Yes. Look at the five-day chart again. See how the price tried to make it above $2 four separate times? Once in the aftermarket on November 22 and three more times on November 23.

All the people who bought at the top are waiting to sell when the price comes back. Beware of these bag holders!

Sometimes the stock trades enough volume to break through. But When QLGN put in a top at $3 on November 23, 200 million shares traded that day.

If the price were to push through $3 on November 29, the volume should be closer to 200 million or ideally higher. The breakout volume has to be big enough to break through resistance.

Intraday Chart

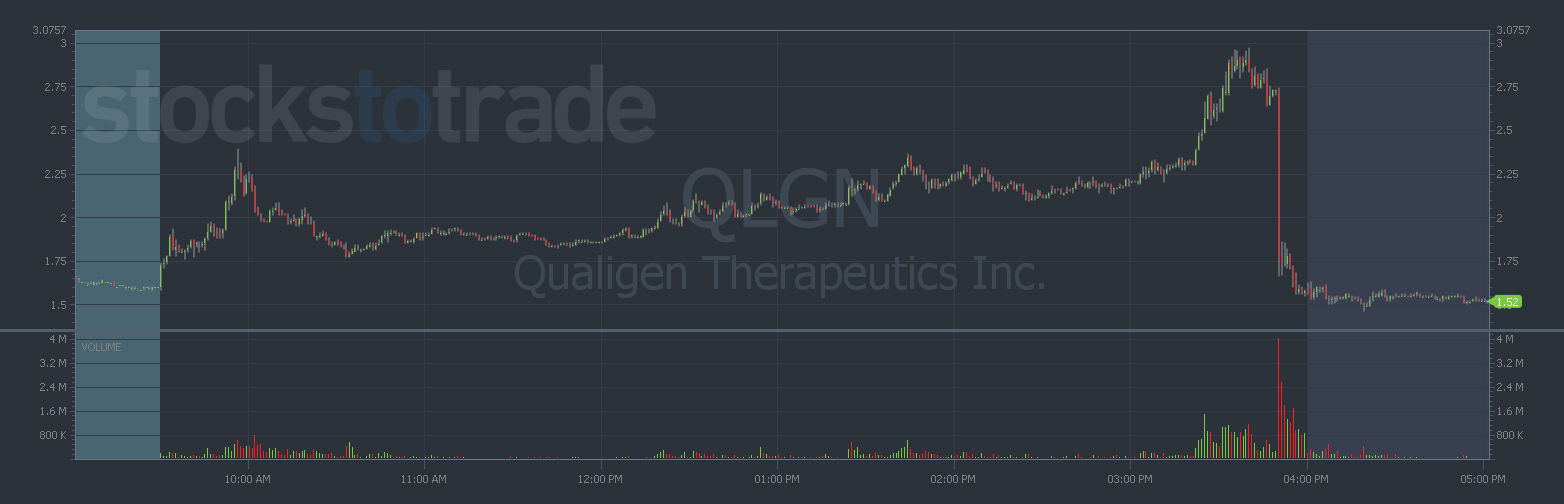

We’re looking for a morning spike and some sideways price action in the afternoon on November 29.

Textbook morning spike, and textbook sideways price action. This is the kind of daily pattern you’re looking for. But it falls apart around 3:20 p.m. Eastern.

Did It Break Out in the Afternoon?

Yes. The stock put in a rough top at $2.25 in the morning. Then it pushes through that level to test $3.

This chart shows a ruined swing trade. The afternoon breakout got stuffed by shorts. Hopefully, everyone who was long sold into strength.

Why Did It Crash?

Back to Bill’s question. He’s noticed that some stocks tank right before the market closes. Just like QLGN on November 29. The truth is, there are many reasons why stocks could dip before the market close…

- Market manipulation, aka “painting the tape.” Sometimes traders buy or sell a lot before the close. They’re trying to influence other traders. It’s prohibited by the SEC but difficult to prove.

- Heavily shorted stocks. For QLGN, shorts were begging it to tank. Stay out of heavily shorted stocks. They’re unpredictable.

- Run into resistance. This is another problem QLGN had. It tried to test the daily resistance at $3 and fell all the way back down.

- Power hours. The first and last hours of the trading day are the most volatile. Expect to see big price movements within these time frames.

Instead of trying to pinpoint exactly why it crashed, recognize how sticking to the pattern saved me from a nasty loss. I was disciplined enough to stay out of a failed swing trade.

That’s a Wrap!

Thanks for joining me for this lesson. Keep studying during the holiday season — there’s so much to learn right now. It might be cold outside for many of you … but the trades can be HOT this time of year.

Check back in on Monday, December 6 for the next TWD newsletter.

Stay focused,

Roland Wolf

Editor, The Wolf’s Den